Hi friends,

Continuing with my topic

why learn Elliottwave ,Today i would show

example of IDFC,The stock which i tracked extensively,And was able to forecast its

move first loosely and later on with perfection.

IDFC TECHNICAL CHART This was dated 22nd jan,In which i forecast ed a small

rise followed by a fall towards 95 and then a rise towards 120+.

What happened in real small rise didnot come ,A sideways move happened few days

then a fall happened towards sub 90 levels and then a steep rally happened towards

128+(The actual high is 139 but that was a spike and was retraced fully intraday).

Then i posted this again few days before Banking license announcement

IDFC BANKING LICENSE HYPE ,In this chart i forecasted a move towards 106+

buy was around 93.50 with stoploss at 92.80 and target was 106+ ,The stock went

much above that this was an ideal safe trade which i was able to generate because

i was able to see the bigger picture of this stock ,So i broke the stock into small parts and

saw lower time frame charts to figure out ideal trade.

Now again lets see the bigger picture

From weekly chart i see that

the stock did a WXY from

november 2010 top till

end august 2013 .A new upmove started from there ,This can be

a X wave or a new impulse of

a bigger degree which we can see

later on as the wave reaches

advance stages.

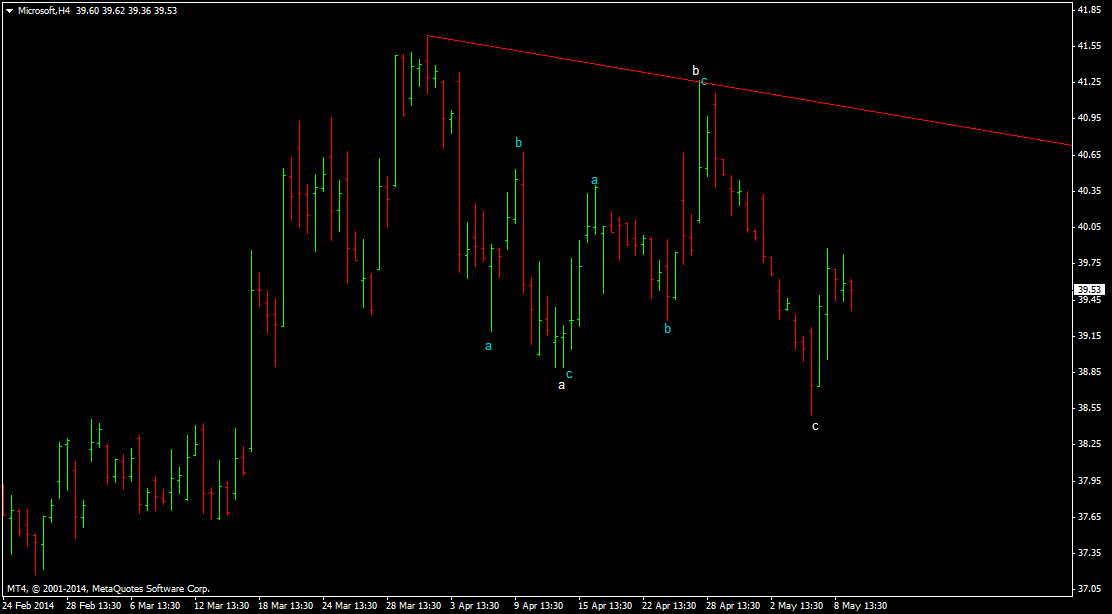

Let me put the structure of the rally from august 2013 lows.

We can see that stock did a abcde

from low of 76,Then stock corrected

and retraced towards 88 from a

high of 117.8 ,And again rose

in 5 wave up and started its correction,Now if this is an X wave it should not cross the slanting

channel trendline i made in

weekly chart ,Look at the

structure of fall from 139 closely

We would have a trade coming up here soon,Track this stock closely.

Regards

Rish