Sunday, May 11, 2014

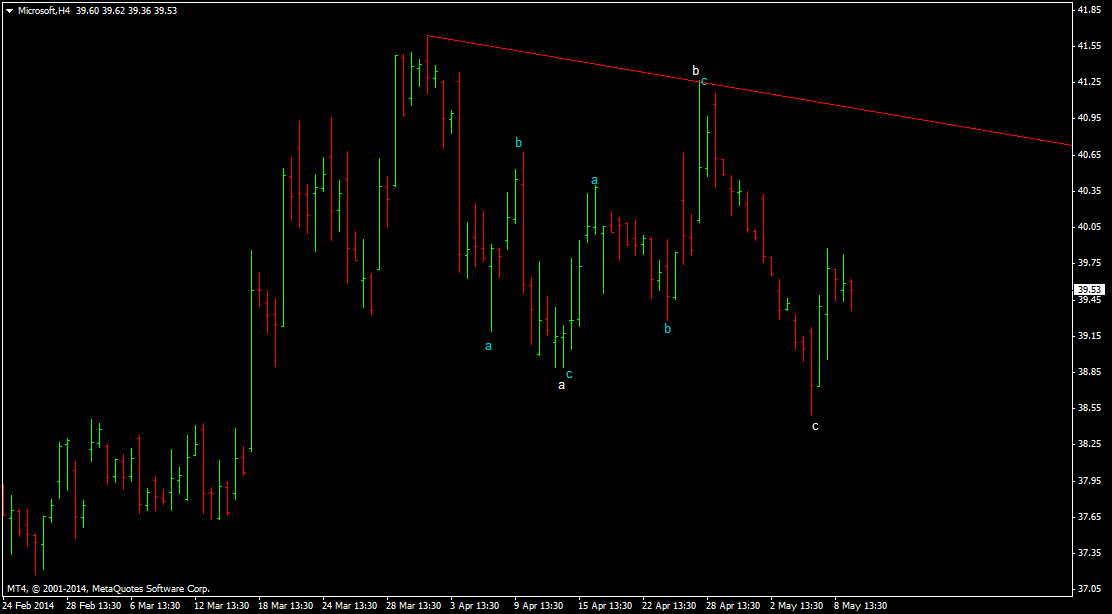

Microsoft trade setup

Saturday, April 26, 2014

NASDAQ wave Analysis

Nasdaq finished a triple zigzag correction

ie wxyxz ,Let me put the chart to see the triple zigzag .

The TOP made in early march

,The fall from there till mid april

took the shape of triple zigzag

which can be seen from the chart

how perfectly triple zigzag

correction took place.

The index is still moving below

trend line resistance ,We did

a or 1 wave from triple zigzag

low ,As long as this low holds

we are moving higher.

Lets see next few days move in Nasdaq i am confident of a long trade emerging here.

Regards

Rish

Thursday, April 24, 2014

Apple computers Trade setup

I some times post about US stocks last time i had posted about

Mcdonalds.My expectation was it shiould rally towards 100$ ,Yes the stock

rallied towards 100$.

Now i am posting Apple trade setup,Let me put the chart.

Its a classic zigzag correction

The stock has done ab leg and

right now ready to do c leg

,Trade idea would be to buy

this stock now and even in dips

as long as 510$ holds ,This

stock can target 550$.

Buy and wait patiently for

the target to be reached.

Lets see how the stock moves

Regards

Rish

Sunday, February 16, 2014

Mcdonalds Trade setup

correction and has reversed to touch higher levels.

Lets look at the chart.

Ideal trade would be

to buy some now and

rest in dips stoploss

a tad below 93,

respective targetswould

be 97 and 99 .

Lets see how Mcdonalds

moves next week

Regards

Rish

Friday, March 13, 2009

>Financial Crisis explained in simple language

She keeps track of the drinks consumed on a ledger (thereby granting the customers loans). Word gets around and as a result increasing numbers of customers flood into Linda's bar. Taking advantage of her customers' freedom from immediate payment constraints, Linda increases her prices for wine and beer, the most-consumed beverages. Her sales volume increases massively. A young and dynamic customer service consultant at the local bank recognizes these customer debts as valuable future assets and increases Linda's borrowing limit. He sees no reason for undue concer n since he has the debts of the alcoholics as collateral.

n since he has the debts of the alcoholics as collateral.

At the bank's corporate headquarters, expert bankers transform these customer assets into DRINKBONDS, ALKBONDS and PUKEBONDS. These securities are then traded on markets worldwide.

No one really understands what these abbreviations mean and how the securities are guaranteed. Nevertheless, as their prices continuously climb, the securities become top-selling items.

One day, although the prices are still climbing, a risk manager (subsequently of course fired due to his negativity) of the bank decides that slowly the time has come to demand payment of the debts incurred by the drinkers at Linda's bar. However they cannot pay back the debts. Linda can not fulfil her loan obligations and claims bankruptcy. DRINKBOND and ALKBOND drop in price by 95 %. PUKEBOND performs better, stabilizing in price after dropping by 80 %. The suppliers of Linda's bar, having granted her generous payment due dates and having invested in the securities are faced with a new situation. Her wine supplier claims bankruptcy, her beer supplier is taken over by a competitor.

The bank is saved by the Government following dramatic round-the-clock consultations by leaders from the governing political parties (and vested interests). The funds required for this purpose are obtained by a tax levied on the sober stupid non-drinkers like me.

Finally an explanation I understand...and why I started drinking again

RESEARCH REPORTS

Saturday, March 07, 2009

>How far could the DOW fall?

Now, with the Dow well BELOW 7200, the critics have fallen silent — and some are even mimicking our forecast that Dow 5000 is dead ahead.

Here’s why even that dire medium-term forecast is still just the beginning — why the Dow could ultimately fall to 3500 ... 2500 ... 1500 or even lower ...

And how you can USE this great bear market to pile up greater profits in less time than you may now believe possible ...

How far will the Dow fall? Where will it hit rock bottom?

If you’re not asking this question right now, you should be.

It is absolutely essential that you get the answer right — for two, compelling reasons:

If you’re wrong, every sucker rally in this bear market could have you buying at the wrong time, then getting your head handed to you as the crash resumes.

But if you get it right, not only can you make a bundle with contrarian investments all the way down ... you’ll also be primed to earn windfall profits at the real bottom — picking up great stocks for pennies on the dollar!

You probably know that the average Dow stock crashed 89% between 1929 and 1932. So the question now is ...

When future history books are written, will they

say that this crisis was less severe than the

Great Depression? About the same? Or WORSE?

Of course, anyone who tells you he knows precisely where the Dow will hit rock bottom is pulling your leg. But consider the evidence ...

Fact #1: Earnings declines are now worse than in America’s First Great Depression. Average earnings have plunged 61% year-over-year, much more than during the 1930s. In fact, the last time earnings declined more than 61% was 141 long years ago!

Fact #2: Consumer losses are worse as well. Last time around, the losses that triggered the depression were largely limited to stock market investors.

This time, the fact that the average NYSE stock has already wiped out HALF investors’ money is only the tip of the iceberg: The equity most folks count on as their #1 source of retirement savings has also been wiped out as our homes have lost a staggering $2.4 trillion of their value in a single year.

Fact #3: Debts are far larger. Like this crisis, the Great Depression was essentially a debt implosion. But in 1929, total debts represented no more than 170% of GDP. This time around, U.S. consumers are buried under a far larger mountain of mortgage debt, auto loan debt, credit card debt and other consumer debts. Result: Total debts are now close to 350% of GDP — TWO TIMES MORE!

Fact #4: Derivatives! The Office of the Comptroller of the Currency (OCC) reports that U.S. banks now hold a $176-trillion mountain of derivatives, many of which are extremely high risk. In 1929, these derivatives were virtually non-existent.

Fact #5: Giant failures. In the first 18 months of the 1929-32 bear market, there were many small and medium-sized bank failures. However, none were as massive or as dangerous as the giant failures we’ve experienced in the first 18 months of this giant bear market.

This time around, the failures (or bailouts) of giants like Bear Stearns, Lehman Brothers, Fannie and Freddie, Washington Mutual, and Wachovia dwarf anything seen in 1929. And even these large failures will be trumped several times over by the impending demise of Citigroup and AIG.

Fact #6: U.S. is a debtor nation! In 1929, the United States was a creditor nation, with substantial foreign reserves. Today, the U.S. is the world’s largest debtor nation, dependent on foreign lenders to keep it afloat. That means that there’s a definite limit to how much longer the U.S. government can continue to borrow to bail out failing institutions.

Fact #7: The economic collapse and debt crisis are far from over! Just this morning, for example, we learned that

* Home prices have plunged 18.5%.

* Sales of existing homes have fallen to the lowest level in twelve years.

* Sales of new homes cratered to an all-time record low.

* 697,000 American families lost a paycheck in February — a 25% increase from January’s abysmal figures.

BOTTOM LINE: This crisis is AT LEAST as severe as the Great Depression, and the decline in stocks could be as well. That means, you could make the case that it could ultimately drive the Dow to as low as 1500.

Martin D. Weiss, Ph.D.

RESEARCH REPORTS

Saturday, January 17, 2009

>American Banking crisis continues in 2009.

Citigroup reports total losses of $18.7 billion in 2008 — $8.29 billion in the fourth quarter ALONE ...

New phase of bank crisis beginning ... soaring unemployment, plunging stocks, canceled dividends, and sinking investment income ahead ...

Just when everyone thought we’d seen the worst of the carnage in the U.S. banking system ...

Despite the $350 billion in TARP funds Washington already spent to save the big banks ...

Despite Treasury Secretary Paulson’s emphatic assurance to CNBC’s Maria Bartiromo that the banks are no longer in danger just a few days ago ...

And regardless of the $138 billion ADDITIONAL lifeline he’s just been forced to throw Bank of America yesterday ...

A new, more virulent strain of the bank panic contagion is now hitting Wall Street!

Just this morning, Bank of America posted its first loss in 17 years — a whopping $1.7 billion in October, November and December — and cut the dividend it pays to stockholders.

Plus, Citigroup, which had already received $45 billion in government handouts, posted its fifth straight multi-billion dollar quarterly loss — $8.3 billion in the last three months of 2008, bringing its total losses for the year to a staggering $18.7 billion!

No wonder Obama’s advisers have freely admitted that they see an increasingly grave banking crisis beginning to unfold! No wonder they have scrambled to gain control over the second $350 billion in bailout funds! And no wonder ...

After the prior phase of this great banking crisis struck last fall, U.S. job losses surged, bringing the total number of paychecks lost by U.S. families to 2.6 million for 2008.

The stock market had a nervous breakdown — with stocks plunging as much as 1,000 points in a single trading session and the Dow crashing by nearly a third in less than 30 days.

Reeling from the carnage, many companies delayed, postponed or even cancelled dividend payments to investors — and the Fed slashed interest rates, cutting yields on other income investments.

But now, it’s looking like last year’s disaster was little more than a dress rehearsal for the new phase of the banking crisis that’s beginning now!

Weiss Research

RESEARCH REPORTS

Sunday, January 11, 2009

>Will US dollar continue to surge??

The U.S. lost 524,000 jobs in December. And as bad as that looks, earlier rumors had the markets preparing for much larger losses. The unemployment rate, on the other hand, jumped more than had been expected — up to 7.2%.

Yet, the resulting price action for the U.S. dollar was rather good. In fact, following yesterday's unemployment announcement, the dollar made serious gains against the euro and the Swiss franc. The buck also gained some ground on the rest of the majors.

To some market watchers, this reaction may seem bizarre ...

After all, a crummy economy can't be good for a nation's currency. But in this instance the market is reacting based on one simple fact: The U.S. holds the key to the global economy.

More on that in a moment.

First, let me explain why ...

Obama's Stimulus Package Will Have

Little Impact on the U.S. Dollar

It's unlikely that the Obama stimulus package will have any notable, direct influence on the way the U.S. dollar behaves in the first half of this year. That's because such efforts will prove ineffective at altering the fundamental forces driving the economy and, to an extent, the markets.

Obama's stimulus won't be any different from previous government bailout efforts — at least as far as spending goes. The fact is, his plans to pump money into infrastructure are not concrete — we don't know exactly what he means and exactly where the money will go.

Very likely, the money won't go toward the immediate and most necessary interests that would normally be defined by the free market.

But let's assume for a moment that some money gets to the consumer or the small business. What will they do with the funds? My bet is that they won't go on spending sprees. Instead, they'll use it to bolster their balance sheets — a process that's already begun and is bullish for the dollar.

What's in Store for Currencies

A sharp return to inflation seems like an obvious conclusion considering the sheer amount of money that's being created and thrown at our country's economic problem. Such a turnabout would cause me to reconsider my expectations for an ongoing U.S. dollar bull market.

And given the Obama "spend our way to prosperity" speech on Thursday, investors may wonder why the dollar hasn't cratered and gold isn't soaring to new heights.

But timing is critical here ...

Many inflation proponents expect an environment of sharply rising prices to return with, or even just before, a recovery of the global economy. They admit the U.S. economy is in deep trouble for many years to come but fail to give the U.S. economy the credit it's due.

You see, a lot rides on the U.S. economy — specifically the country's consumers. And the consumer depends on jobs, and jobs depend on business wealth creation.

The U.S. consumers' recent spending patterns have created tremors across the global economy. We're witnessing a period of demand destruction.

And for economies built around supplying U.S. consumers with goods, and economies built around supplying the materials to make those goods, deteriorating consumer demand is the worst possible scenario.

Right now governments throughout the world are throwing around money to stimulate demand. But unfortunately, consumer attitudes have changed to the point where demand stimulation will likely prove ineffective — sentiment toward taking on more debt has changed and has been replaced by real fear.

Adjustments to supply are necessary to get the U.S. economy back on track — that's one of the things recessions are designed to do. And this means with a wallowing U.S., the rest of the world slows down even faster.

Again, in currencies, it's all relative. It may seem perverse for the U.S. dollar to rally through this. But considering the ramifications of this global rebalancing, maybe it makes sense for the rest of the currencies to lose out.

Best wishes,

Jack

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.

RESEARCH REPORTS

Friday, December 26, 2008

>The great American Bailout

Fed Chairman Ben Bernanke has done it. He's thrown down the gauntlet. Desperate times call for desperate measures, as they say, and the Federal Reserve has now gone "all in."

Specifically, Bernanke and other Fed policymakers ...

• Slashed the federal funds rate to a range of 0% to 0.25% from the previous target of 1%. That is the lowest level in U.S. history. The Fed is now pursuing the same "ZIRP" (Zero Interest Rate Policy) strategy Japan tried several years back to boost its economy.

• Said they would "support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level." That's Fed-speak for "We're going to print money and flood the banking system with massive amounts of reserves."

• Reiterated the Fed's intention to buy "large quantities" of debt sold by Fannie Mae and Freddie Mac, as well as the mortgage backed securities (MBS) that those agencies guarantee.

• In fact, they upped the ante by saying the Fed "stands ready to expand its purchases" if necessary. And it said it was continuing to study whether it should also buy long-term U.S. Treasury bonds.

• Said the Fed will "continue to consider ways of using its balance sheet to further support credit markets and economic activity." What does that mean? Potentially whatever the Fed wants it to mean, as far as I can tell.

The Fed and Treasury are already directly manipulating the secondary market for home mortgages. And they've announced that they're going to intervene in the consumer loan market, too.

Why shouldn't commercial real estate mortgages come next? After all, credit conditions there are tight, aren't they?

Or how about buying the Dow? Higher stock prices would allow troubled banks and corporations to raise money and support the economy ... wouldn't they?

What about corporate bonds? Junk bonds? Artwork? My old football card collection?

I used to think the idea that the Fed might buy assets of all shapes and sizes as kind of crazy — "Kookburger" stuff, to use one of my colleague's terms.

But now? Nothing surprises me.

The 10 Questions

We Should ALL Be Asking ...

Wall Street couldn't be happier with what the Fed and Treasury are doing. Thunderous applause erupted in trading rooms after the Fed's statement came out Tuesday. And the buying of stocks came fast and furious. Ditto for bonds.

I watched fund manager after fund manager — you know, the supposed capitalists out there — come on television and praise the Fed. Heck, they were urging even more socialistic ... er, intervention ... to support the market.

Apparently almost everyone agrees with the idea of a small group of men and women deciding that THEY know the "right" price for mortgage bonds, Treasury bonds, or other assets — while the entire universe of private investors out there has things "wrong."

And the consequences? Nothing to worry about, according to the pundits ...

Question #1: Is the 10% plunge in the U.S. dollar in the span of a few days a clear vote of "no confidence" in the Fed's policy from currency traders?

Pundits' answer: Who cares! We can keep shafting our foreign creditors and they'll come back for more. They always do.

Question #2: How about the deterioration (albeit minor) in the cost of insuring U.S. debt against default?

Pundits' answer: Who cares! We're the U.S. and investors will always flock to our shores.

Question #3: Aren't we completely abandoning 200+ years of American free market principles?

Pundits' answer: Don't bother us with that long-term stuff.

Question #4: Isn't the Fed submitting prudent savers to total abuse by slashing the returns they can earn on their savings accounts and Treasuries?

Pundits' answer: Who cares about them! We need Americans to spend, spend, spend!

Question #5: Was it wise to "fix" the dot-com bubble with easy money ... which led to the housing bubble that has since popped ... and which the Fed is now trying to fix with ... you guessed it ... more easy money?

Pundits' answer: Quit whining! The Fed never makes mistakes. You just don't get it.

Question #6: The idea that maybe, just maybe, the cure for inflated home prices is ... drum roll please ... lower prices? Prices that allow NEW buyers to purchase homes without taking out ridiculous mortgages — and eat bread and cereal to make their payments?

Pundits' answer: We can't have that! We have to prop them up!

Question #7: What about the hundreds of billions of dollars of additional debt our country is taking on? The first TRILLION-dollar deficit in U.S. history? The massive interest costs my little girls, and probably THEIR children, are going to pay for years and years as a result of all these bailouts?

Pundits' answer: Who cares! That's someone else's problem.

Question #8: And finally, have we forgotten the whole concept of occasionally having a cleansing recession? A downturn that, while painful, cleans out all the crud — the crud built up by years of recklessness by greedy bankers, clueless speculators, hands-off regulators, crooked scam artists, and head-in-the-sand policymakers?

Pundits' answer: Nope. We have to prevent that at all costs. Don't bother us with that "healthy business cycle" claptrap.

Look, I keep hearing about how the Fed is doing a great job. I keep hearing that "there are no atheists in the foxhole" and that the government has to do what it's doing to save us all from apocalypse.

But I have two more questions ...

Question #9: What if the economy and asset prices are going to get where they're headed ... no matter WHAT the government does?

What about the idea that we're just delaying the inevitable by trying to prop up home prices?

And the biggest question of all ...

Question #10: What if we spend all this money and end up with nothing to show for it — except for a multi-trillion dollar bill that we'll be paying for the rest of our lives?

Sound crazy?

Then maybe you should check out the December 16 piece in the Wall Street Journal entitled "Barack Obama-san." It chronicled how Japan spent exorbitant amounts of money trying to revive its economy after the twin real estate and stock market busts there.

The steps that Japan took included a 10.7 trillion yen stimulus package in August 1992 ... a 13.2 trillion plan in April 1993 ... 6.2 trillion in September 1993 ... 15.3 trillion in February 1994 ... 14.2 trillion in September 1995 ... 16.7 trillion in April 1998 ... 23.9 trillion in November 1998 ... and 18 trillion in November 1999.

Grand total: A whopping 118.2 TRILLION yen or about $1.35 trillion at today's dollar-yen exchange rate.

Yet it was all for naught. The economy still suffered a "Lost Decade" of deflation and lackluster growth. Or as the Journal explained:

"Keynesian 'pump-priming' in a recession has often been tried, and as an economic stimulus it is overrated. The money that the government spends has to come from somewhere, which means from the private economy in higher taxes or borrowing. The public works are usually less productive than the foregone private investment."

Maybe Bernanke will get what he wants. Maybe his helicopter drops of money will pay off. Maybe the incoming administration, and its team of economic advisors, will do better than the Bush bunch.

But considering the success rate of the past government programs targeted at helping the housing and credit markets (TARP anyone?), I wonder why nobody is worried about waking up another day older ... deeper in debt ... and right back at square one.

Until next time,

Mike

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com

RESEARCH REPORTS

Thursday, December 18, 2008

>$50 Billion Fraud: "Bigger Than All the Rest Put Together"

RESEARCH REPORTS

Sunday, December 14, 2008

Wednesday, December 10, 2008

>Dow jones Technical Analysis

In the last analysis Dow jones as was discussed Dow was in 4th of 3rd main wave,

which finished near 9700.From there 5th of main 3rd started which

ended near 7500.A good 1200 points.

So the killer 3rd main wave of dowjones is over,And presently we are in

4th main wave.

According to chart the parallel line channel holds much importance which

projects the upper resistance at 9500.

downside 8200-8000 is a good support .

These corrective ups give great opportunity for Traders Dowjones already saw

great run 7500 to 9000.

Regards

Rish

RESEARCH REPORTS

Tuesday, November 25, 2008

>Berkshire Hathaway Shareholders meeting at Omaha(2008)

Summary By Some Gentleman who attended the meet.

______________________________

I had the good fortune to attend the 2008- Berkshire Hathaway Shareholders meeting at Omaha, Nebraska a few weeks back.

It was a wonderful experience listening to and learning from the Master Investor- Warren Buffett himself and all I can say is that he stands alone as the reigning deity of financial world's Mt Olympus!

The degree of humility and composure he exhibited, although he is the richest and most well respected human is stunning!

I tried to take some notes and would like to share with you some of the best questions and answers which came across during the conversation between we mortals and God.

Having read about him, observed him and worshipped him for a few years now, I think it is reasonable to believe that this guy is exactly what he seems: a plain-speaking, tee totaling man of uncrackable integrity who works really, really hard and sticks to his investing and management principles through boom and bust which makes him a freak of nature since he is above normal human tendencies. He is like a comet streaking through the heavens every 75 years or so.

The questions the shareholders threw at him for 7 continuous hours ranged from finances, life, religion, career, politics, sports and several other streams. And he answered everything with a Zen like calm and confidence.

Even if you are least bothered about investments and finances, I insist, Pl read on.

================

What does it take to become a successful investor? Brilliance or Smartness?

Neither, Success in investing doesn't correlate with I.Q. Once you have ordinary intelligence, what you need is the temperament to control the urges that gets other people into trouble in investing.

When do you deicide to invest in a firm?

The best thing that happens to us is when a great company gets into temporary trouble. We want to buy them when they're on the operating table. (Mr. Buffett bought Coke when it had its biggest fiasco after launching New Coke; he bought American Express when it went through a loss making phase in the early 60's)

What do you look for in people when they come to sell their

I don't look for the usual credentials such as an MBA, a pedigree (Harvard, Wharton), or cash reserves or market cap of their firm. What I look for is just a passion in their eyes; I think that's the key. A person who is hungry will always do well. I prefer it when people evenafter selling stay on and work for the firm; they are people who can't wait to get off their bed to get to work. Passion is everything; there is no replacement for innate interest.

Mr. Buffett, you told us that Berkshire Hathaway has $ 45 Billion in cash. Why aren't you investing?

Up until a few years back I had more ideas than money. Now I have more money than ideas.

When do you plan to retire?

I love my job; I love it so much that I tap dance to work. Mrs. B, the founder of Nebraska Furniture Mark worked until she was 104, she died within 6 months of her retirement, that's a lesson to all my managers, don't retire! I personally am going to work 6-7 years after I die, probably that's what they mean when they say- "Thinking out of the Box"!!

Why do stock market crashes happen?

Because of human nature for greed and insecurity. The 1970s were unbelievable. The world wasn't going to end, but businesses were beinggiven away. Human nature has not changed. People will always behave in a manic-depressive way over time. They will offer great values to you."

What are the things that are taught wrong in Business school and the corporate world?

I like such open ended questions, I think Business schools should refrain from teaching their wards about profit making and profit making alone, it gives a sense of 1 dimensional outlook to the young students that loss is a curse. In reality, in the corporate world, failure and loss making are inevitable. The capital market without loss is like Christianity without hell. I think they should teach the student on how to buy a business, how to value a business? Not just on how to determine the price of a business. Because price is what you pay, value is what you get.

Do you still hate Technology stocks?

With Coke I can come up with a very rational figure for the cash it will generate in the future. But with the top 10 Internet companies,how much cash will they produce over the next 25 years? If you say you don't know, then you don't know what it is worth and you arespeculating, not investing. All I know is that I don't know, and if I don't know, I don't invest."

How to think about Investing?

The first investment primer was written by Aesop in 600 B.C. He said, 'A bird in the hand is worth two in the bush.' Aesop forgot to saywhen you get the two in the bush and what interest rates are; investing is simply figuring out your cash outlay (the bird in the hand) and comparing it to how many birds are in the bush and when you get them."

How do you feel after donating $ 40 Billion to the Bill and Melinda Gates foundation? You are a hero to us!

I feel nothing. I haven't sacrificed anything in life. I have had a good life. I donated after I turned 75. I think I admire those people who sacrifice their time, share their food and home, as the people to be emulated not me. Besides, what is money before a man's life?

What do you think are the pitfalls in donation?

I have never donated a dime to churches or other such organizations; I need to believe in something before I end up doing that. I have beenobserving the Bill & Melinda Gates foundation for years now and I am confident they will do a fantastic job of making use of the money. I am a big believer in Outsourcing, others believed in me as an Investor and gave their hard earned money to invest. I believe in Bill Gates, he is a better donor than me.

Why do you work from Omaha and not Wall Street, New York?

Wall Street is the only place where people alight from Rolls Royce to get advised by people who use the Public transportation system.

You seem to be so well read, tell us how it all started.

My father was a stock broker, so we had all these financial books in our library. He introduced me to those classics and I got into them. Iam lucky that my father was not a fan of Playboy! Reading is the best habit you can get. Well, you can learn from teachers too, and have mentors but there are so many constraints attached- they will talk fast, talk slow, they might talk like a pro or they might be terrible communicators. Books are a different animal altogether, I love reading! The beauty about reading and learning is that the more you learn the more you want to learn.

People who join Berkshire Hathaway seldom leave. How do you get along well with all your executives?

I try to get quality people. I always say - Hire someone in your organization who is better than you are. If you do that, you build a company of giants. If you get people worse than yourself, you build a company of dwarfs. And do not try to do everything yourself. Delegate the jobs and look out of the window. The results will come. That's how you build institutions. It happens only when you empower others, believe in others. Iam an investor, Iam very secured at that, I have no clue how to make Coca-Cola or how to dole out credit cards (Mr. Buffett owns 8% of Coca-Cola and 13 % of American Express). I understand the wisdom of the aphorism that you cannot please all thepeople all the time. Of Course, you will always find qualities that you don't like in people around you, but if you observe carefully the love of the work unites you both. There is no point in being obsessive about a bad quality in a person, whom you otherwise respect.

I am a small time businessman from Dallas, Texas, what do I need to do to hit big time?

Be patient, Achieving your financial goals and dreams will not happen overnight. As much as we would all really love to accomplish our goals in a few years, this is an ongoing process. Defining your financial goals is not a one-time task; you need to keep adding new plans atdifferent stages in your life. We all admire the skills of Olympic ice skaters, pro golfers, and concert pianists. But do we remember that they didn't acquire their skills overnight? They had to practice hours on end for years to achieve their dreams. The key to success is to continue learning throughout your life with a voracious appetite.

I think it is marvelous that you have had a golden run with investing, how did you do that?

My rule is to be fearful when others are greedy, and be greedy when others are fearful. Besides, I call investing the greatest job in the world because you never have to swing. You stand at the plate; the pitcher throws you General Motors at 47! U.S. Steel at 39! And nobody calls a strike on you. There's no penalty except opportunity lost. All day you wait for the pitch you like; then when the fielders are asleep, you step up and hit it. Stay dispassionate and be patient. You're dealing with a lot of silly people in the marketplace; it's like a great big casino and everyone else is boozing. If you can stick with drinking Coke, you should be OK. First the crowd is boozy on optimism and buying every new issue in sight. The next moment it is boozy on pessimism, buying gold bars and predicting another Great Depression, most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well.

Mr. Buffett you have seen so many crashes and recessions, your take on facing recessions and stock market crashes?

If past history was all there was to the game, the richest people would be librarians. Every scenario is different. But always remember, Tough times do not last. Tough people do.

What is the 1 biggest advice you would impart to a young investor like me?

Think for a moment that you are given a car and told this is the only car you would get for the rest of your life. Then you would make sure that you car is taken care of well, it is oiled and detailed every now and then. You would make sure that it never gets rusted, and you would garage it. Think of yourself as that car. You just get 1 body, 1 mind and 1 soul. Take care of it well. Invest in yourself that would be my advice.

You personally know many of the Financial executives who are engineers of the current turmoil in the financial world, surprisingly even after record losses, those executives receive astronomical salaries and bonuses and arrogantly declare that they deserve it, why dint you advice them from making such decisions and what's your view on their justification for their pay?

I like sharing my ideas but don't like imposing my ideas on anybody. It doesn't make sense and is a waste of time. If somebody has decidedthat they know everything that is there to know, nobody can help them. The best way to learn and succeed is to know that we know nothing. There is an entire universe out there and still some of us think we can know everything. In the world of investing a few people after making some money tend to imagine they are invincible and great. This is the worst thing that could happen to any investor, because it surely means that the investor will end up taking unnecessary risks and end up losing everything – arrogance, ego and overconfidence are very lethal. Personally I don't feel too comfortable with too much extravagance, because I always think like an investor. My thought process doesn't see a lot of value in a fancy car or a designer suit. Thinking like an investor always is very important to bring in a sense of disciplineand focus. Before reading balance sheets and investing you need to make sure your outlook and mindset is that of an investor. Never let ego, arrogance and over-confidence control you - not just as an investor but also as a human being. You will never have internal peace if you are unable to look at everybody around you with love, compassion and understanding. Irrespective of who the person is, he or she can teach you something you don't know. I have learnt so much from people all around me and I wouldn't have been able to learn all thesewonderful things if I had not spoken to them with a smile. To quote Sir Isaac Newton- If I have seen farther than others, it is because I have stood on the shoulders of giants.

It was a 7 hour conversation and I could just capture some of the best questions and answers. As 37,000+ dazed, amazed and grateful shareholders trooped out of the stadium after the meeting, I found myself recalling one of my favorite quotes-

"A man has to learn that he cannot command things, but that he can command himself; that he cannot coerce the wills of others, but that he can mold and master his own will: and things serve him who serves truth; people seek guidance of him who is master of himself".

RESEARCH REPORTS

Saturday, November 15, 2008

>Dowjones Analysis(ELLIOTT wave)

turned out to be 4th wave formation according to Elliott wave theory.

See first chart the wave started from the big black arrow,Till october panic low thats

7900 we completed 3 waves down .

Then a possible bearish Flat to complete 4th wave.

Come to next chart which shows the expanded 4th wave chart,Which shows (3,3,5)

Bearish flat.4th wave ended at 9700.

From there we are witnessing a possible 5th down.

The next few days movement of Dow should clear the wave structure to some more extent.

Nifty too in 4th wave but we are behind dowjones as dowjones looks to have completed 4th wave

wheras Nifty still in 4th wave.:)

NIFTY ANALYSIS

Regards

Rish

RESEARCH REPORTS

Thursday, November 13, 2008

>American Financial Turmoil.A new TWIST!!

GM needs $50 billion more ...

Fannie and Freddie could need $100 billion more ...

AIG gets $150 billion refinancing ...

PLUS Congress has a NEW $100-billion-plus stimulus package on the way!

Q: Where will it all end?

A: In the greatest orgy of USA government borrowing in recorded history!

General Motors: $25 billion wasn’t enough — needs $50 billion more to survive! GM’s sales are down 20% in a year. Its share price is down nearly 90% — from $31.14 a year ago to $3.36 at yesterday’s close.

The last time GM stock was this low, Harry Truman was in the White House, and Elvis Presley was in grammar school. And now, analysts are warning that America’s largest automaker may soon be worth zero.

American International Group (AIG): $150 billion refinancing announced yesterday!

First, the Fed gave AIG an $85 billion line of credit in a failed attempt to save America’s largest insurer.

When that failed to work, the Fed added $38 billion more through its borrowing facility.

And when the company continued racing towards failure, the Fed agreed to buy more billions of AIG’s toxic commercial paper

Despite the $100 billion already spent to bail out Fannie, the company has revealed that it lost a staggering $29 billion in the third quarter — an announcement that means America’s largest mortgage lender will probably need untold billions more to avoid a total shut-down.

A new twist!!!

WASHINGTON — The Treasury Department on Wednesday officially abandoned the original strategy behind its $700 billion effort to rescue the financial system, as administration officials acknowledged that banks and financial institutions were as unwilling as ever to lend to consumers.

But with a little more than two months left before President Bush leaves office, Treasury Secretary Henry M. Paulson Jr. is hoping to put in place a major new lending program that would be run by the Federal Reserve and aimed at unlocking the frozen consumer credit market.

The program, still in the planning stages, would for the first time use bailout funds specifically to help consumers instead of banks, savings and loans and Wall Street firms.

Treasury officials said they hoped to invest about $50 billion from the bailout fund into the new loan facility, with the aim of helping companies that issue credit cards, make student loans and finance car purchases.

As envisioned, the Treasury would put up about 5 percent of the money that a company would use for lending and private investors would put up perhaps 20 times that much by buying bonds issued by the new program.

Despite the mind-boggling amount of money that Congress has authorized the Treasury to spend — $350 billion immediately, and another $350 billion that Congress would approve under a fast-track procedure — Mr. Paulson is running short of money and time.

This new twist in bailout strategy looks promising lets wait and watch its Result!!!.

RESEARCH REPORTS

Sunday, November 09, 2008

>Raining Bank failures in America!!

Franklin Bank, a Houston, Texas-based bank and Security Pacific Bank, a Los Angeles, Calif.-based bank were shut down by state regulators Friday, marking the 18th and 19th bank failures this year.

Franklin Bank (FBTX) had total assets of $5.1 billion and total deposits of $3.7 billion as of Sept. 30, 2008, according to a statement on the Federal Deposit Insurance Corp.'s Web site.

Read full story here Raining bank failures

RESEARCH REPORTS

Thursday, November 06, 2008

>American financial crisis & Barack Obama

As a result, many Wall Street institutions are using billions and billions of taxpayer dollars to pay for fat cats' bonuses.

* Goldman Sachs, which is getting $10 billion from the bailout plan, is paying out $6.85 billion in bonuses, according to media reports. That's $210,000 per employee. And that's despite a 47% drop in its profit and 53% drop in its share price.

* Morgan Stanley, which is also getting $10 billion from our government, is doling out $6.44 billion in bonuses or $138,700 per employee, even though its profits tumbled 41% and its shares are off by 69%.

* And even the failures at Lehman Brothers are collectively getting over $1 billion in bonuses.

Some conservatives have been bemoaning the "nationalization" of America's big banks. Yet we didn't nationalize anything — we don't control those banks. They're free to spend the bailout money as they please.

And we got hosed.

If Only We Got A Deal Like Buffett Did ...

Just compare the deal Uncle Sam got for Goldman Sachs shares to the deal Warren Buffett made.

Warren Buffett invested $5 billion in Goldman Sachs in return for preferred stock and warrants to purchase common stock in the future. Buffett's preferred shares pay a sweet 10% dividend.

But Goldman and the other big financial institutions needed more money to cover their bad bets.

So, 20 days later, Treasury Secretary Hank Paulson came along and made an investment for preferred stock and warrants in nine banks. Only the government's preferred shares pay a measly 5% dividend.

It gets worse ...

United Steelworkers Union president Leo Gerard recently wrote in a letter to Paulson that seems to ooze anger:

"Dollar for dollar, Buffett received at least seven and perhaps up to 14 times more warrants than the Treasury did, and his warrants have more favorable terms."

Is it relevant that Paulson used to be the head of Goldman Sachs, one of the financials being bailed out?

Heck yeah!

Under his stewardship, Uncle Sam ended up paying $125 billon for what Warren Buffett thought was worth just $62.5 billion.

If the rest of the $700 billion bailout is dispersed using the same math, we'll be gifting $350 billion to America's biggest bankers — those bonuses have to come from somewhere — and then overpaying for what the other $350 billion buys us.

One Thing the Banks Are Not Doing With the Money:

Loaning It Out Like They Were Supposed To ...

In their defense, the banks are saying that no one is queuing up for loans. Su-u-u-u-re. Just tell that to any auto dealer who can't get money together to make payroll.

One place where big investment houses and banks did decide to put money to work was in shorting stocks.

A bunch of financial firms lined up to short Volkswagen. It seemed like a smart move, right? Cars sales are tanking. Problem is, at the same time, Porsche was stealthily buying Volkswagen shares until it acquired a controlling interest. Then the short squeeze was on. Those bailed-out firms suddenly had to cover their short positions and lost billions of dollars.

Some of them lost more on the Volkswagen deal than they ever lost on Lehman Brothers imploding!

The banks' post-bailout behavior — no loans, blowing bailout money on bad investments — irked Barney Frank, chairman of the U.S. House of Representatives Financial Services Committee, one of the people who helped Paulson ram the Emergency Economic Stabilization Act of 2008 (EESA) through Congress.

Frank is supposed to be one of the "smart ones" in Congress. Here's what he had to say:

"I am deeply disappointed that a number of financial institutions are distorting the legislation that Congress passed at the President's request to respond to the credit crisis by making funds available for increased lending. Any use of these funds for any purpose other than lending — for bonuses, for severance pay, for dividends, for acquisitions of other institutions, etc. — is a violation of the terms of the Act."

Nice words. Too bad they're as hollow as a rotten log.

The language of the bailout does talk about homeowner assistance ... limit executive pay ... provide for government audits ... etc. But it doesn't dictate serious limits on how the banks can use the money. Barney Frank may have thought he had an understanding with Paulson, Fed Chairman Ben Bernanke and the big banks.

But that's like having an understanding with Al Capone.

Seriously ... If Frank is as smart as everyone says he is, and he's making a deal with banks that have already shown they're capable of blowing hundreds of billions of dollars on derivatives, shouldn't he demand what he expects from them in writing before handing them a big bag of our money?

I guess I shouldn't single out Congressman Frank. Plenty of others in Congress went along with Paulson's plan. They say you get the leaders you deserve. But did we really deserve this?

The $700 Billion Bailout Is a BIG, FAT FAILURE!

Have you heard the chuckleheads on CNBC line up to say: "The government can end up making money on this bailout"?

Sure, when pigs fly!

The plan is that as the housing market recovers, the government will sell its holdings — all that worthless mortgage paper from the banks — and recoup its money. Never mind that many of those mortgages will never pay off ... that there was outright fraud ... that inflation is going to eat up any remaining value of the collateralized debt obligations.

In short, this plan won't work.

The sad thing is this $700 billion financial Frankenstein is just a drop in the bucket of the wholesale looting of the public purse that has gone on under the Bush Administration. Over the past eight years, Bush added approximately $5 trillion to the national debt ceiling.

The point of my rant here is that the U.S. government has blown $700 billion — and much more — bailing out criminals in pin-striped suits who got themselves into a multi-billion-dollar mess of their own devising, and then they insist on giving themselves bonuses!

It's High Time to Stop Bailing Out These Bums ...

There is going to be another bailout. I know, after all the facts I've laid out for you here, you probably want another government bailout like you want to have your liver extracted by a guy with a switchblade.

But as long as Washington can print money, they'll throw it at problems. So I have a suggestion for the next President: Stop bailing out Wall Street fat cats.

I don't care how much they scream about how they're the underpinning of America's financial system. If Wall Street bankers cannot survive after all the money we've thrown at them, tell them to drop off the banks' keys at the U.S. Capitol. We'll find someone else who can do the job.

And while we still have some money left in the Treasury ... while the U.S. dollar still holds some value ... please spend the money on something useful.

3 Ways to Spend the Next Bailout Package,

And Create New American Jobs That Can't

Be Shipped Overseas ...

I know that the next President will be tempted to bail out the consumer. After all, Wall Street got its loot. So why shouldn't America's middle class?

And consider ...

* Nearly one in five U.S. mortgage borrowers owe more to lenders than their homes are worth. And the rate may soon approach one in four. About 7.63 million properties, or 18%, had negative equity in September, according to a report by First American CoreLogic.

* Manufacturing in the U.S. contracted in October at the fastest pace in 26 years.

* Over one million jobs have been lost in the last 12 months. In September, another 159,000 jobs disappeared.

Never mind recession — we could be headed for Depression.

The Reuters-Jefferies CRB Index of Raw Industrials, a gauge of the cost of 22 items including scrap copper, cotton and hogs, is a good indicator of economic health.

Plunge in CRB Raw Materials Index: A sign of worse to come for the economy?

During the eight-month recession that began in March 2001, this index fell 8.7% as U.S. industrial production dropped as much as 5.7%. The industrial-commodity index fell 19% during the recession that began in July 1981, as factory production plunged as much as 7.1%.

How much has it fallen now? A whopping 31%, and factory production has only fallen 2.8% ... so far. Again, that means much worse is likely to come.

So I know that it will be tempting for the new American President to provide "mortgage relief" and prevent foreclosures.

But ... that would just be propping up the same failed system that Wall Street hoodwinked us with in the first place. Our housing market needs to fail — so prices can find a new base and economic activity can start again.

And throwing billions and billions of dollars at consumer debt would just send it into the same black hole that Wall Street knows so well.

So how would I spend the next bailout package?

Here are three ideas:

1) Rebuild the nation's power grid ...

We need an efficient power grid that can carry renewable energy — solar from the Mojave Desert and wind from the Great Plains — to the population centers of the U.S. Too bad our power grid is 100 years old and falling apart at the seams. And demand is growing every year.

Upgrading the grid brings multiple benefits: Along with fewer catastrophic failures, we should also see a 15% reduction in total demand through real-time incentives and a 20% drop through smart appliances. And vehicle-to-grid (V2G) cars that charge at off-peak times during the night, then share any excess power stored in their batteries with the grid during the day, would enable the U.S. power grid to shift as much as 50% of its energy to intermittent sources like wind and solar power.

2) Rebuild, expand and electrify America's railroads ...

There are already proposals for a "second bailout package" to build more highways and bridges. While I'm all in favor of repairing America's existing bridges, we don't need more highways for oil-dependent cars. We need more railroads for an energy independent America — building those lines is a good bottom-up way to boost the economy.

We could electrify all 36,000 of America's main railroad lines for about $90 billion. It would also save about 185,000 barrels of oil per day. And every train we can take off diesel fuel brings us one step closer to telling the oil-rich sheiks where they can shove their barrels of oil.

3) Fund a "moon-shot" electric car program ...

I'm talking about developing mass-market battery-powered cars (hybrid or plug-in) that achieve at least 100 mpg of gasoline on new fleets by the year 2015.

There have been some steps in the right direction on this. As part of the EESA bailout, the U.S. passed the Energy Improvement and Extension Act of 2008 — a fancy-pants way of saying a tax credit for hybrid vehicles. It provides up to $7,500 per vehicle for the first 250,000 cars. That's a maximum of $1.88 billion. That's less than one-fifth of what Goldman Sachs got in the bank bailout.

And the Department of Energy recently awarded $30 million to Ford, GM and General Electric to develop and demonstrate plug-in hybrid electric vehicles. Come on ... just $30 million? There are individual Wall Street bankers who get bigger bonuses than that!

Bottom line: We'd better start investing in our transportation future, or it will be a long time waiting for the bus to come along.

All three of the programs I've outlined above have one thing in common: Good American jobs that can't be shipped overseas. If you want to jump-start the economy, that's a 1-2-3 that might work.

The American Society of Civil Engineers (ASCE) has estimated that the country needs to spend $1.6 trillion over five years to fix our infrastructure, from dilapidated levees to congested roadways and ports.

Sure, $1.6 trillion is a nice start. But if you add up all the various bailouts that the government has thrown at the global financial system, you get closer to $2 trillion. Is America's energy future more important than keeping the fat cats purring?

I think so.

Sean Brodrick

http://www.moneyandmarkets.com

Tuesday, November 04, 2008

>Dowjones Analysis

After overpowering first trendline resistance presently

Trading near short term trendline resistance.To show more

strength Dowjones would have to overpower this trendline.

The pre election rally would show more momentum if 9550 is

taken out on closing basis.

Two closes above 9550 Dowjones can target 9800.

Though ,I expect retrace from this trendline if the upmove has to

show more strength.

Downside if 9300 is broken 9000 retest is not ruled out.

Regards

Rish.

Monday, November 03, 2008

>The U.S. Economy Stinks,But dollar smells like Roses!!

Still, there's no denying that a GDP contraction of any amount is unappealing. And when it comes to many of the recent U.S. economic indicators, most everything's been unappealing ... if not downright ugly.

But across the pond we're finding that Europe's economy is uglier yet.

The U.S. Economy Stinks,

But Currency Traders Don't Smell a Thing ...

Investors who haven't let up on the doomsday scenario and still believe that the buck is going to hell in a hand basket are getting their heads handed to them.

Because even though the U.S. economy stinks right now, the U.S. dollar smells like roses. And the dollar index has surged as much as 16% in just the last three and a half months.

The analysis of global money flow has changed. Currency traders are doing just what they should: They're looking past purely domestic fundamentals and going global with their assessments.

The financial crisis impacting the globe is front and center. And when you think about the U.S. position amongst the ruckus, you realize the U.S. and the dollar aren't quite as bad off as many domestic seers, or those with a vested interest in the dollar doomsday story, would have you believe.

One of the key items U.S. dollar perma-bears mold their argument around is the U.S. current account deficit. But I'm of the opinion that the current account is of little, if any, relevance as it pertains to the multi-trillion dollar economy and, more specifically, the U.S. dollar.

The New Concern:

Toxic Economies ...

Lacking many features of strong, well-rounded economies, emerging markets have put all their chips into their exports sector. They've come to rely almost entirely on neighboring and developed economies buying up cheap goods and raw materials. And they failed to adequately invest in the domestic side of their economies, leaving them woefully exposed to external demand for growth and foreign investors for funding.

That generous global demand has plunged. Therefore, it's easy to understand why emerging economies' stocks and their currencies are being hit the hardest.

What's more, as quickly as these economies gained the backing of foreign investors in the last couple years, these same foreign investors are running for cover just as fast.

Europe Too Cozy With Emerging Markets ...

When it comes to emerging markets, Eastern and Central Europe account for $1.6 trillion in loans from G10 countries' banks. Asia and Latin America are next on the list — recipients of $1.5 trillion and $1 trillion, respectively, according to Morgan Stanley's Global Economic Forum.

And if you break down the loan originators, Western Europe and the United Kingdom are where roughly 45% of these emerging market loans came from. Whereas only 9% originated from U.S. or Japanese banks. In fact, European and UK banks are more exposed to emerging economies in Eastern Europe, Asia and Latin America.

Take, for example, the situation in Hungary.

It's believed that nearly 90% of mortgages in Hungary are denominated in Swiss francs, not Hungarian forints. In other words, banks in Switzerland are extraordinarily exposed to Hungary's emerging economy. That means the Swiss are exposed to a rising number of defaults.

And this is not an isolated incident. Western Europe and the UK have been extremely active in cross-border lending. And it's going to come back to bite them.

So ...

The Flight to Safety Gives

The Dollar the Upper Hand ...

I've taken a long-term dollar bullish view. But even I have been surprised by the greenback's persistent strength.

The dollar's historic move is showing that it has the upper-hand in what's become a nasty currency beat-down. And the deleveraging that's taking place in emerging markets is fueling the drive. Also helping out is significant repatriation of funds to the U.S., a risk-averse environment.

The downturn overseas and rush to the exit, evidenced in global stock markets' decline, is simply creating demand for dollars.

Specifically, I'm looking for this skirting money flow and overexposure to emerging market debt to further weigh down the euro and the British pound for the next several months.

We're seeing proof that the dollar is nowhere near forfeiting its position as global reserve currency. After all, the credit and economic crisis isn't sending money to Europe for safety.

So whoever thought the euro was ready to fulfill the role of world reserve currency can think again.

Sunday, November 02, 2008

>10 American Financial Meltdowns in the Past Century

Since its independence more than 230 years ago, the United States has grown to have the largest economy in the world (GDP of $13.8 trillion as of 2007, by the way. That's $13,800,000,000,000). But we didn't get there without quite a few bumps on the road.

To put today's economic trouble into perspective, let's take a look at the 10 financial disasters in the United States in the past century:

1. The Panic of 1907

Floor of the New York Stock Exchange in 1907. Photo: Helen D. Van Eaton

Background: At the time, the young US stock market was in a decline - it was off 25% since the beginning of the year and Wall Street was jittery over the tight money supply.

Trigger: Then along came Otto Heinze with his get-(even)-rich(er)-quick scheme. In October of 1907, Otto, along with his brother, a copper magnate named Augustus Heinze, and the ice king (yup, he sold ice - remember, this was before the age of household refrigerators) Charles W. Morse, aggressively bought shares of United Copper, thinking that they could corner the market on the stock. Their plan failed spectacularly, and immediately bankrupted the trust companies and banks that provided the financing.

Runs on banks immediately ensued as depositors pulled their money from banks that had dealings (or rumored to have dealings) with the trio. In a little less than two weeks in the Panic of 1907, a chain reaction had left 9 trust companies and banks bankrupt.

The Solution: At the time, the United States had no central bank (President Andrew Jackson had abolished the Second Bank of the United States some 6 decades earlier), but we had J.P. Morgan.

The 70-year-old financier stepped in to bail out, er ... save trust companies worth saving and let those who were too far gone to fail. The infusion of cash helped stop the domino effect of failing trust companies, but more money was needed.

So here's what he did:

Morgan gathered 50 trust company presidents at his library, told them to come up with $25 million on their own and left them in a large room. He withdrew to his librarian's office. At 3 a.m., he called in one of his sleep-deprived lieutenants, Ben Strong, for a review of a trust company's books. Strong gave his report, then headed to the library's front doors and found them locked. Morgan had the key in his pocket. No one would leave until the trusts ponied up. The presidents continued to talk. At 4:15, Morgan walked in with a statement requiring each trust company to share in a new $25 million loan. One of his lawyers read it aloud, then set it on a table. "There you are, gentlemen," said Morgan.

No one moved.

Morgan drew Edward King, head of the Union Trust, to the table. "There's the place, King," he said, "and here's the pen." King signed. The other presidents signed. They set up a committee to handle the loan and supervise the final-stage bailouts of endangered trusts. At 4:45, the library's heavy brass doors swung open and let the bankers out. (Source)

Aftermath: The government realized that only having people like J.P. Morgan in charge of saving the entire country's economy was kind of a bad idea, so it created the Federal Reserve System.

2. Wall Street Crash of 1929

The trading floor of the NYSE right after the crash.

Background: In the Roaring Twenties, optimism was everywhere: the Great War, as World War I was called back then, was over and advances in technology seemed limitless. Along with that optimism was an incredibly speculative bull market: stocks went up four fold in value in that decade.

Hundreds of thousands of Americans borrowed money to play the stock market. They bought stocks with just a fraction of the value in cash and financed the rest by borrowing from the broker ("buying on margin," if you've never heard it before). Needless to say, stocks became overvalued fast.

The Crash: What goes up, must come down - but it doesn't have to come down all in one day. The Wall Street Crash of 1929 came in forms of three "black" days.

In the morning of October 24, 1929 - later nicknamed "Black Thursday"- a massive sell-off happened. More than 3 times the normal amount of shares were traded and stock prices tumbled. Richard Whitney of J.P. Morgan and Company came to the trading floor ... and instead of halting trading like everyone expected, he started buying confidently and the market recovered. The market actually went up the subsequent Friday and a little down on Saturday (back then, they traded on Saturdays). And then ... the bottom fell off.

On Monday, October 28, 1929, nicknamed Black Monday, the market fell 13% and the next day, nicknamed Black Tuesday, the market fell another 12%. Financiers like General Motor's William C. Durant and the Rockefeller family stepped in and bought stocks to show confidence, but their efforts failed to stop the slide. (Source)

That week (with heaviest losses over the first two days) the market lost $30 billion, ten times more than the annual budget of the government and more than what the US had spent in all of World War I.

Over the next few weeks, the stock market suffered sharp declines though the true bottom wasn't reached until July 1932. Over three years, the stock market dropped a staggering 89%. It would take about 25 years for the stock market to recover and re-attain the 1929 level. (Source)

Aftermath: The Wall Street Crash of 1929 led directly to ...

3. The Great Depression

"Migrant Mother," a photo by Dorothea Lange depicting Florence Owens Thompson,

a destitute pea picker in California, mother of seven children, age 32. (Source)

Background: Stung by heavy losses on Wall Street, consumers began cutting expenditures. With lowered demand, businesses started laying off people (US unemployment rate rose to 25% by 1933) - which fed an ever-worsening cycle and plunged the US economy into a depression.

As debtors defaulted on their loans, banks began to fail, which led to bank runs as depositors attempted to withdraw their money en masse, triggering even more bank failures. Today, your deposit is insured in the event of a bank failure, but in 1930s, there was no such thing: when a bank failed, its depositors lost all of their money. In the first 10 months of 1930, 744 US banks failed and their depositors lost more than $140 billion. Before the decade was over, about 9,000 banks failed. (Source)

Hooverville in Levittown, New York (Source)

Hooverville: Many people thought that President Herbert Hoover did nothing to save them from the Great Depression. That's just not true: Hoover did a few things, including deporting about 500,000 Mexicans to Mexico (half of which were actually born in the US and thus were legal citizens) and increasing tariffs on imports - which caused other countries to retaliate and US exports to plunge by more than half, but nothing worked.

Hard Times Are Still "Hoover"ing Over Us, photo of two children in a Hooverville (Source)

Many of the people made homeless by the Great Depression lived in makeshift shantytowns called Hoovervilles. They used "Hoover blanket" (old newspaper) to keep warm, wave "Hoover flag" (an empty pocket turned inside out) and drink "Hoover soup" at restaurants (poor people would pour ketchup, salt and pepper into their drinking water at restaurants, then tell the waitress that they didn't see anything they wanted on the menu). Those who were relatively better off drove "Hoover wagon" (a car pulled by a horse because the owner couldn't afford gas). (Source)

Solution: In 1933, the newly elected President Franklin D. Roosevelt initiated the New Deal, which included work relief program for the jobless, financial aid to farmers and business reform, including setting minimum wages and maximum weekly hours. Roosevelt encouraged trade unions and forced businesses to work with the government to set prices (later found to be unconstitutional).

In Roosevelt's first term, unemployment fell by two third and the economy stabilized; full recovery, however, didn't occur until the start of World War II.

Aftermath: The Great Depression had a far reaching effect, even until today. Social Security, the Tennessee Valley Authority, the Securities and Exchange Commission, the Federal Deposit Insurance Corporation (FDIC), and the Federal Housing Authorities are direct products of the New Deal that are still active today.

4. 1973 Oil Crisis

Cars waiting in line at a gas station (1979).

Photo: Warren K. Leffler, Library of Congress

Background: In October 1973, Syria and Egypt launched a surprise attack on Israel on the Jewish day of atonement or Yom Kippur. This set off a twenty day war known as the Yom Kippur War (or Ramadan War), in which the Arab forces were defeated.

The embargo: Angry over Western nations' support of Israel, members of the Organization of Petroleum Exporting Countries (OPEC) as well as Egypt and Syria shut off oil export to the United States, Western Europe, and Japan.

The crude oil price immediately quadrupled to $12 per barrel (I know. Twelve bucks. How quaint when compared to today's prices!) which led gasoline price at the pump to jump 40% from 38.5 cent to 55 cent per gallon in 1974 (again, I know). The oil shock led to a huge drop in the stock market. The New York Stock Exchange lost $97 billion in value in just six weeks.

US Government responded by rationing gasoline. Long gas lines formed at the pump. In many places, motorists with even-numbered license plates were allowed to buy gas only on even-numbered dates and those with odd-numbered plates could buy only on odd-numbered dates. (Source)

Aftermath: To help reduce consumption, the federal government imposed a national maximum speed limit of 55 mph and mandated fuel efficiency standards for car manufacturers. The government also created the Strategic Petroleum Reserve and the Department of Energy.

5. Black Monday (1987)

The Crash: On Monday, October 19, 1987, the US stock market crashed. The Dow Jones Industrial Average dropped 508 points or 22.6%, the largest one-day percentage decline in the stock market history. At one point during the day, so many shares were being sold that "the New York State Stock Exchange ticker fell behind and TV newscasters couldn't tell how much the market had fallen." (Source)

The Culprits: The most popular culprits for the 1987 Black Monday were program trading and a new financial hedging method called portfolio insurance. These two things caused massive stock sell offs and drove down the stock price (note that other factors such as the weak dollar, large US trade deficit, and overvaluations of stock values might have played a role as well) (Source)

Program trading is easy to explain: in the early 1980s, the use of computers became increasingly popular in Wall Street. Traders began to use computers to execute rapid trades based on a pre-determined condition (say, sell when a stock price dropped to a certain point). Dropping stock prices trigger these automated trades, which flood the market with stock shares and caused an even steeper decline in stock prices.

Portfolio insurance is a little bit (okay, a lot) more complex. In 1976, two young Berkeley finance professors named Hayne Leland Mark Rubinstein thought of a way to "insure" a portfolio investments of stocks similar to the way insurance protects an asset. For a price (a kin to an insurance premium), their trading system can guarantee that an investment never loses more than a pre-set (and relatively small) amount.

To do this, portfolio insurance uses financial instruments called derivatives. Most people understand buying and selling stocks - if you buy a share of stock for $1 and sell it for $3, then you've made a profit of $2. Derivatives, on the other hand, let you speculate on the future price of a stock (or a commodity, or really anything at all) without ever owning a single share. For example, you can buy a futures contract, essentially an agreement to purchase a stock say a week from now for $1. If the price of the stock is greater than $1, then you've made money. If the price of the stock is less than $1, then you've lost money. At no point in time do you actually buy the stock!

In the case of portfolio insurance, say you have $1000 in stocks that you want to safeguard from falling in value by next week. Then you sell a futures contract for the stocks. If the value of your stocks dropped, you've lost value in your stocks but gained money from the the futures contract. (Yes this is simplistic, but that's the basic idea).

Without getting into mind boggling technical details, suffice it to say that the portfolio insurance method linked stock prices to the futures index. The whole thing would work but for one teensy flaw: during a panic sell off, there is little market liquidity - you can try to sell stocks, but without any buyer, you effectively can't sell it at any price.

Aftermath: In response to Black Monday, the New York Stock Exchange instituted trading rules (the so-called "circuit breakers") to pause trading if the market fell precipitously. The Federal Reserve also get to play a really big role in ensuring liquidity by pumping billions of dollars into the banking system.

Remember the term derivatives. We'll see that again, soon enough!

6. Savings & Loan Crisis (1989)

Lincoln Savings and Loan, back in its heyday of 1965 (Source)

Background: A Savings and Loan institution is kind of like a bank: people deposit their money in it in the forms of savings, and the S&L gives out mortgages (or loans) to the local community. S&Ls have existed since the 1800s and they were tightly regulated until the late 1970s.

In the late '70s, the newly available money market funds offered much higher interest rates than the S&L, so people started pulling their money out of S&Ls. As a response, S&Ls asked for government deregulation (which they got*) - effectively, S&Ls could then raise interest rates on deposits and make way more loans than before with little oversight. There was a regulatory body, the Federal Home Loan Bank Board (FHLBB), but it was understaffed and its officers were accused of being chummy with the industry.

The S&L Crisis: In the real estate boom of the early '80s, many S&L grew extremely large, extremely fast. Between 1982 and 1985, S&L assets (many of which were speculative real estate holdings and commercial loans) grew 56%. In Texas, 40 S&Ls tripled in size, with some doubling each year. (Source) Needless to say, many were overextended (some were technically bankrupt, but according to the new deregulation rules, they could remain open and thus continued to make bad loans).

By 1987, 505 S&L institutions failed. Some, like those in Texas, failed spectacularly - losses in just that one state comprised more than half of all S&L losses nationwide. The deposits were guaranteed by the Federal Savings and Loan Insurance Corporation (FSLIC, just like the FDIC guaranteed bank deposits) - but because of the amount, it turned out that the FSLIC itself was bankrupt!

All in all, by 1995, 747 S&Ls or half of all the S&L institutions in the United States went bankrupt.

The Keating Five: You may have heard of the term "Keating Five," here's the story in a nutshell. In 1984, construction magnate Charles Keating bought Lincoln Savings and Loan of Irvine, California. Before then, Lincoln S&L was a profitable yet conservatively run Savings and Loan institution. Keating fired the existing management and loaded up Lincoln's investment portfolio from $1.1 billion to $5.5 billion by buying land and junk bonds.

In 1986, the FHLBB initiated an investigation on how Lincoln was doing business. Keating, who was politically connected, asked 5 US senators, for whom he had made large contributions, to intervene (which they did). In 1989, Lincoln went bankrupt and more than 21,000 mostly elderly investors lost their life savings (Lincoln had misled them to switch their FDIC-insured holdings to bonds that weren't guaranteed).

The five senators, namely Alan Cranston, Dennis DeConcini, Donald Riegle, John Glenn, and John McCain, were investigated by the the Senate Ethics Committee. Cranston was reprimanded, Riegle and DeConcini were criticized for acting improperly, whereas Glenn and McCain were cleared of impropriety but criticized for poor judgment.

The Solution: In 1989, newly elected President George H.W. Bush announced that he would rescue the troubled Savings and Loan industry. The bailout was priced at a shocking $60 billion, which actually turned out to be overly optimistic. The total cost of the S&L mess was closer to $153 billion, of which $124 was footed by the taxpayers. (Source)

Aftermath: A whole bunch of reform, including the dissolution of the FHLBB and the FSLIC, to be replaced by other regulatory bodies. Freddie Mac, which had been under control of FHLBB, was put under the US Department of Housing and Urban Development, which gave it one additional goal: to buy subprime mortgages to enable low-income families to afford buying houses (we'll see this again).

*Note: The deregulation of the Savings and Loan industry happened with the Garn-St. Germain Depository Institutions Act of 1982. The bill was very popular - one of its provisions was allowing adjustable rate mortgages or ARMs. (Yup, you've guessed it - we'll see ARMs again)

7. Long Term Capital Bailout (1998)

Background: In 1994, legendary bond trader John Meriwether left Salomon Brothers and founded his own hedge fund. He attracted the top financial minds at the time, including two Nobel Prize economists, Myron Scholes and Robert Merton. The hedge fund was named Long Term Capital Management. Meriwether raised $1.25 billion in capital from investors to start. It was the largest funding raised for a hedge fund in history.

LTCM, as the hedge fund was commonly known, wanted to make money the scientific way: in leveraged arbitrage.

At this point, it's probably necessary to define the terms for some people. Hedge fund is a private investment fund that aims to make money using a variety of (often exotic) financial instruments. These funds typically don't buy stocks or bonds, instead they trade derivatives (see "Black Monday" above). The "hedge" in hedge fund comes from their habit of "hedging" their portfolio - meaning that if they hold an asset, they will also place a bet that the value of the asset would go down. If their asset did go down in value, that "hedge" bet would pay off to offset the loss. In theory, this allows the fund's investments to be risk-free. In practice, as we shall see, that's obviously not the case.

Arbitrage is a fancy name for a simple concept: the way to make money by exploiting price differences in two different markets. For example, say that you spot a vase selling for $10 in one swap-meet and for $15 in another. If you buy that vase for $10, then go to the other swap-meet and sell it for $15, you've just made a profit of $5 (less cost of gas, of course).