Tuesday, October 31, 2006

Monday, October 30, 2006

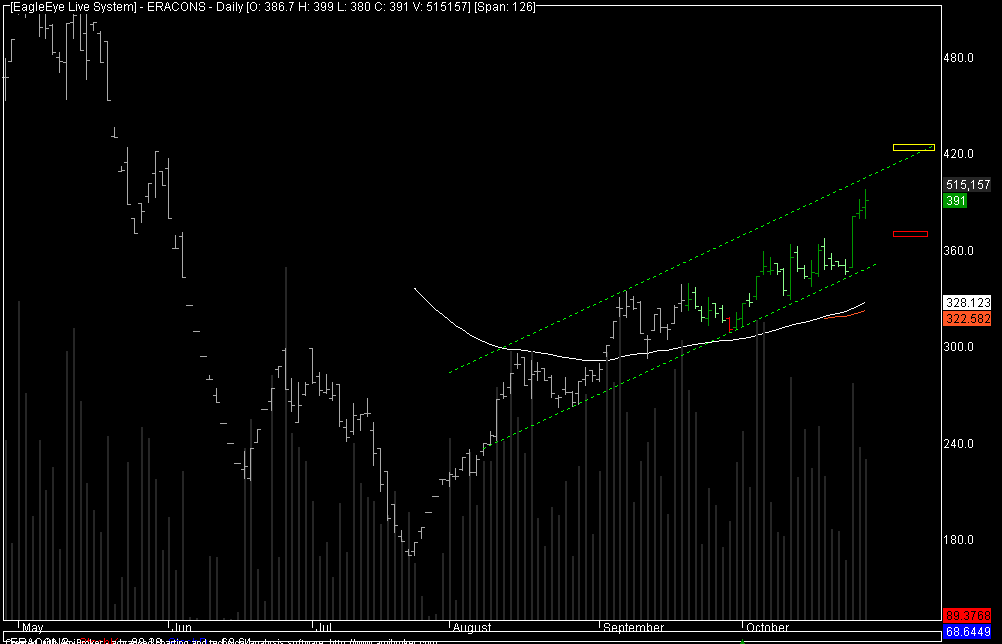

ERA CONSTRUCTION

Sunday, October 29, 2006

ADANI EXPORT

ALOK TEXT

Saturday, October 28, 2006

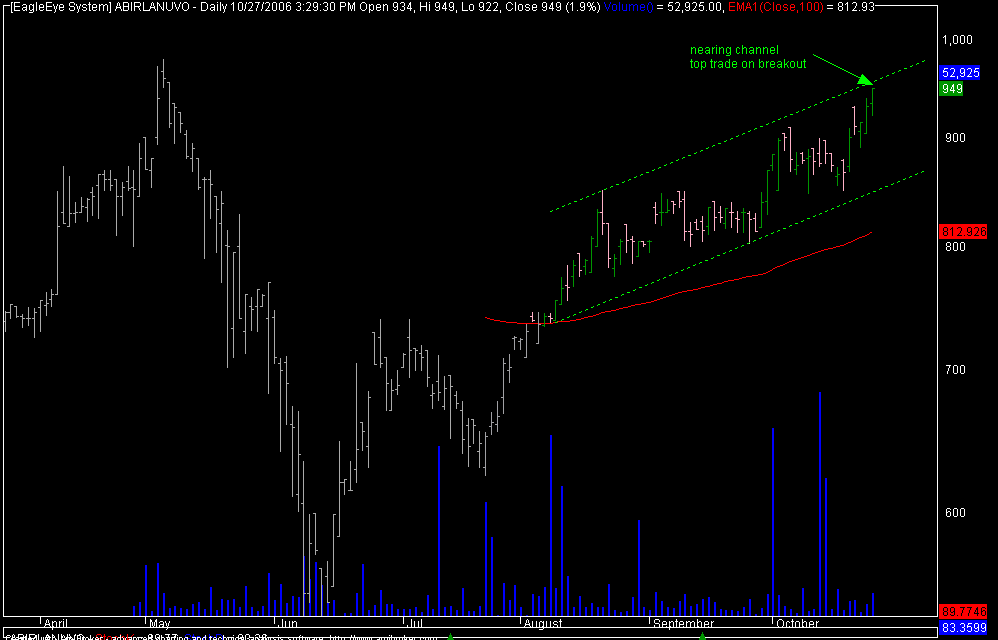

ADITYA BIRLA NUVO

Friday, October 27, 2006

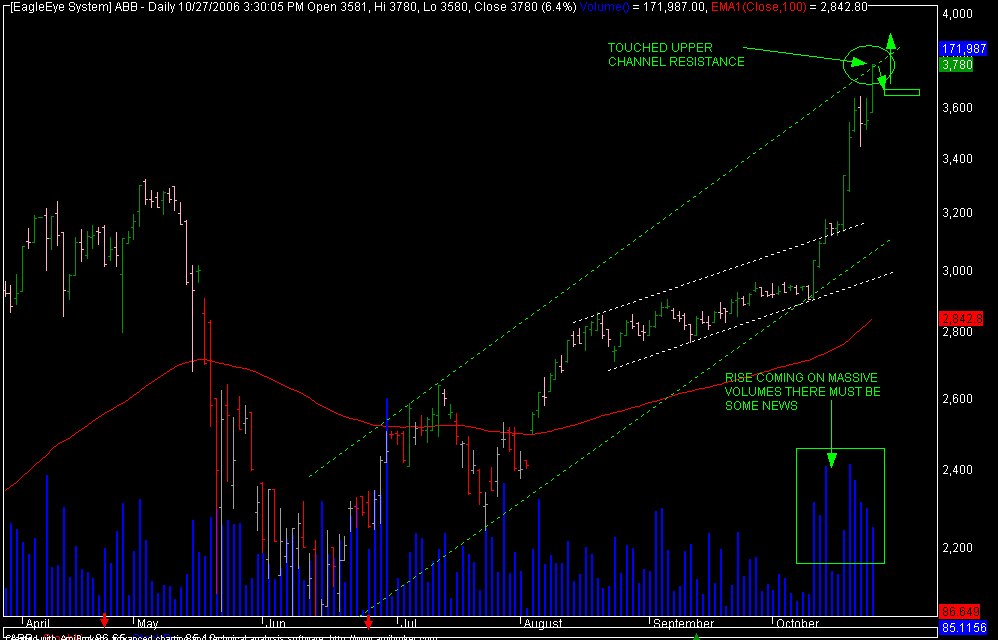

ABB

ABB is rising again after a small pause and this rise signals some good news must be coming we see the rise of abb which started from last week around 2950+ levels thats massive 790 points that too came with massive volumes if you are long in this script can keep 3640 as trailing sl risky traders can take position in it after some dip as the stock has exactly touched upper channel

cheers

rish

Thursday, October 26, 2006

Wednesday, October 25, 2006

FEW AFL'S(amibroker formula language)

hi

following are few afl codes giving you diffrent set of conditions to short list accoding to the written code

1 18 day breakouts

2 100 day ema crossover

will be sending few more in coming days.

PS:-THESE ARE CODES WHICH WILL RUN ONLY WITH AMIBROKER

following are few afl codes giving you diffrent set of conditions to short list accoding to the written code

1 18 day breakouts

2 100 day ema crossover

will be sending few more in coming days.

PS:-THESE ARE CODES WHICH WILL RUN ONLY WITH AMIBROKER

Tuesday, October 24, 2006

APTECH

Monday, October 23, 2006

Sunday, October 22, 2006

Saturday, October 21, 2006

ABB

RELIANCE

Friday, October 20, 2006

Tatas to pay $1 bn cash, Corus backs bid

The board of Anglo-Dutch steelmaker Corus Group is believed to have recommended accepting Tata Steel's $8.6 billion takeover offer, and an announcement is likely tomorrow.

The board of Anglo-Dutch steelmaker Corus Group is believed to have recommended accepting Tata Steel's $8.6 billion takeover offer, and an announcement is likely tomorrow.Deal to be announced today; workers seek job protection.

The Tata group is likely to pay nearly Rs 4,500 crore ($1 billion) in cash to finance Tata Steel’s bid to acquire Corus Group, which is believed to have received the target company’s backing.

Corus, the Anglo-Dutch steelmaker, will announce tomorrow its support for the Tata bid, which put the enterprise value of the target company at nearly $10 billion. The details of the financing of the bid will also be announced tomorrow.

The Corus brass is said to have received the clearance of the Corus pension fund trustees.

Investment bankers said the contours of the leveraged buyout — a financing method in which the target company’s assets are used as collateral — would include about $5.5 billion (nearly Rs 26,000 crore) to be raised in debt against Corus’ cashflow.

On its own, Tata Steel will raise nearly $2.5 billion (about Rs 11,320 crore) in debt. Of this, a part will be refinanced against the equity of Tata Sons, the holding company of the group.

The amount the Tata group has to pay for Corus, which has an annual capacity of 18 million tonnes, includes a break-up fee of 1 per cent of the transaction amount. This will be forfeited in case the group pulls out of the deal.

A new dimension was added to the acquisition saga today with Community, the British steel workers union, seeking safeguards on wages and pension for Corus employees.

A British Member of Parliament also wrote to Prime Minister Tony Blair asking the government to initiate talks with Tata Steel to ensure there were no lay-offs. Corus has 24,000 workers in Britain and 16,000 in the Netherlands.

When contacted, a Corus spokesperson said: “We are a listed entity. We will inform the stock exchange in case of a decision, immediately.” The Tata Steel spokesperson was not available for comments.

If the deal is approved by the Corus board tomorrow (it will propel Tata Steel to the sixth position among the world’s largest steel companies from its existing rank of 56), any counter-bid will have to be approved by Corus’ pension fund trustees.

The Tata group will set up a special purpose vehicle in London for the acquisition, following the pattern by which it acquired tea company Tetley six years ago, the group’s first audacious overseas takeover.

In midmorning trading in London today, Corus’ shares were at 482 pence, down 1 per cent from yesterday’s close.

ABN Amro and Deutsche Bank are advisers to Tata Steel while Credit Suisse, HSBC and JP Morgan Cazenove are advising Corus.

source:-BUSSINESS STANDARD

Thursday, October 19, 2006

Wednesday, October 18, 2006

RELIANCE CAPITAL

Tuesday, October 17, 2006

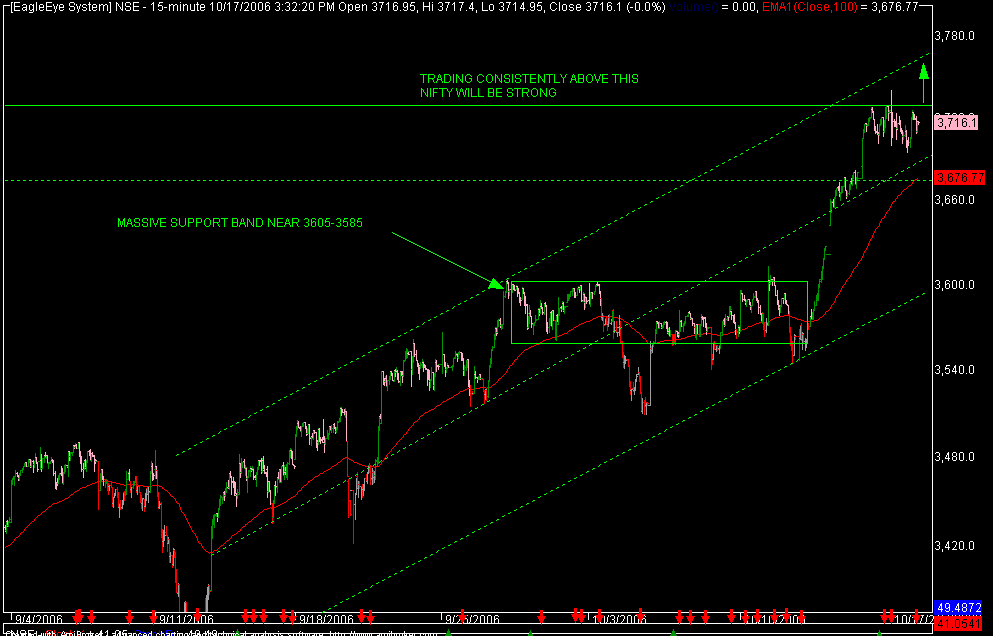

NIFTY 18TH OCT

BOMBAY DYEING

Monday, October 16, 2006

Sunday, October 15, 2006

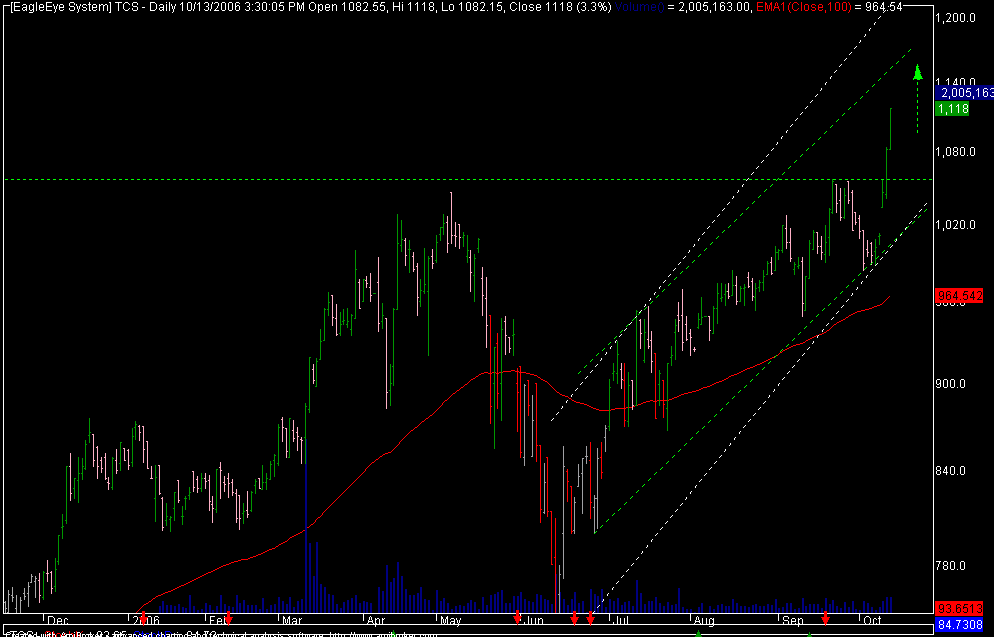

TCS

TCS saw massive speculative buying(reason infosys came with fantastic numbers)on expectation of very good result monday being the result dy for TCS it could be volatile trade carefully on upside 1140-60 is resisting upper channel resistance above which can target 1200. on lower side 1050+ is strong support.

cheers

rish

Saturday, October 14, 2006

DAY TRADING PIT FALLS

There are a number of things that can go wrong when you day trade stocks over which you may have little or no control. These form part of the risks associated with day trading of which you should be aware. Here are some of the common pitfalls encountered by many day traders relating to the execution of trades:

There are a number of things that can go wrong when you day trade stocks over which you may have little or no control. These form part of the risks associated with day trading of which you should be aware. Here are some of the common pitfalls encountered by many day traders relating to the execution of trades:1. Execution of your orders are delayed due to order backlog or technical problems causing you to be filled at a higher price than you intended to pay.

2. You enter the wrong stock symbol when placing your order online.

3. You lose track of the many orders you have placed during the day.

4. Your online broker's Web site goes down during the day and you cannot complete your trades.

5. Crossed or locked prices may occur for a period of time during which orders are not executed at all.

6 Failure or delays of real time data feeds can cause you to take an mistaken view of market conditions.

7 You misread a price quote and enter an order on the basis of this mistaken quote.

8 Your ISP goes down during the day leaving you without an Internet connection.

9 You place a market order as the price falls and find your order executed minutes later at a higher price because of the large backlog in unfilled orders for the stock.

10 You find that the online order function you wanted is temporarily unavailable.

11 You find out that, on a particular day, the Level II Nasdaq bid-ask size is not updated as frequently as it should be or is inaccurate.

12 You act on a ''hot tip'' from a newsletter or Web site that caters to day traders and later learn that this source is paid by third parties to make recommendations.

Friday, October 13, 2006

Day Trading Personality - Do You Have It?

I think you would agree that when you think about it, successful day trading requires certain personality traits. Someone who is easily crushed by a wrong decision would not make a good day trader, where a more resililient type would probably do well at day trading. Day trading requires that you be able to take emotion out of your decisions, so if you are the type who gets attached to a stock (yes, it happens) you need to either change this trait or stay away from day trading altogether.

few must have things for day trading

1.online account

2.live data for stocks

3.technical charting software

But trading online is not that safe any more with technological advances many times you can fall prey to it, go through the following article which I took from a website

Day traders simply can not do without online trading. Online trading is required due to its speed and convenience, and online accounts provide 24 hour access which allows daytraders to plan and enter orders at any time of day. Identity theft is generally not a concern at the level of your online trading account provider since these providers go out of their way to protect you data and your money. You need to be careful for identity theft attempts that happen right on your own computer:

* Keystroke Logging Programs

* phishing

* Poor Choice of Passwords

few must have things for day trading

1.online account

2.live data for stocks

3.technical charting software

But trading online is not that safe any more with technological advances many times you can fall prey to it, go through the following article which I took from a website

Day traders simply can not do without online trading. Online trading is required due to its speed and convenience, and online accounts provide 24 hour access which allows daytraders to plan and enter orders at any time of day. Identity theft is generally not a concern at the level of your online trading account provider since these providers go out of their way to protect you data and your money. You need to be careful for identity theft attempts that happen right on your own computer:

* Keystroke Logging Programs

* phishing

* Poor Choice of Passwords

Thursday, October 12, 2006

Wednesday, October 11, 2006

Tuesday, October 10, 2006

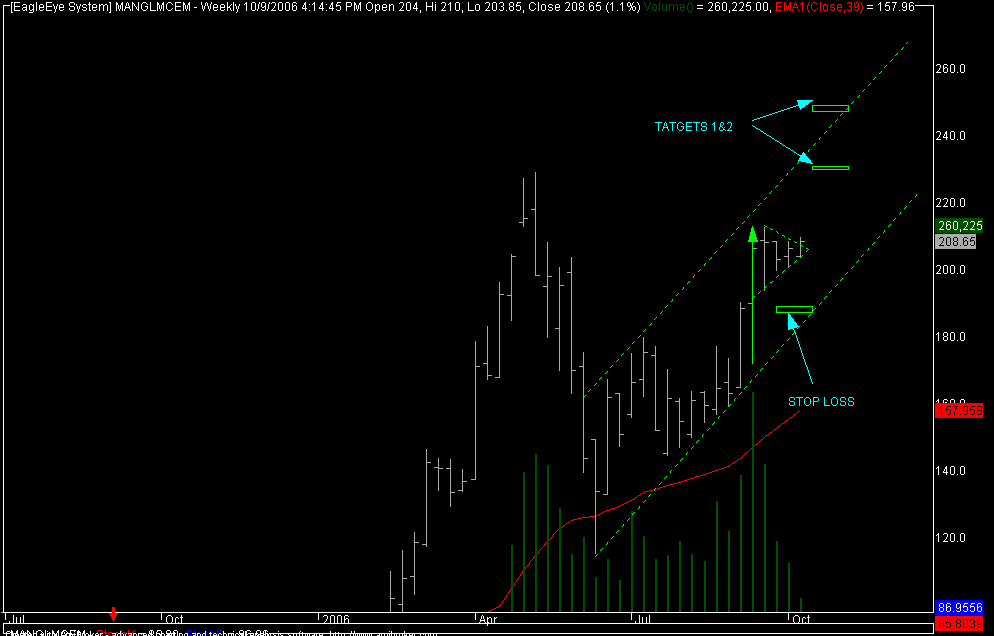

MANGALAMM CEMENT (pole and pennant)

Monday, October 09, 2006

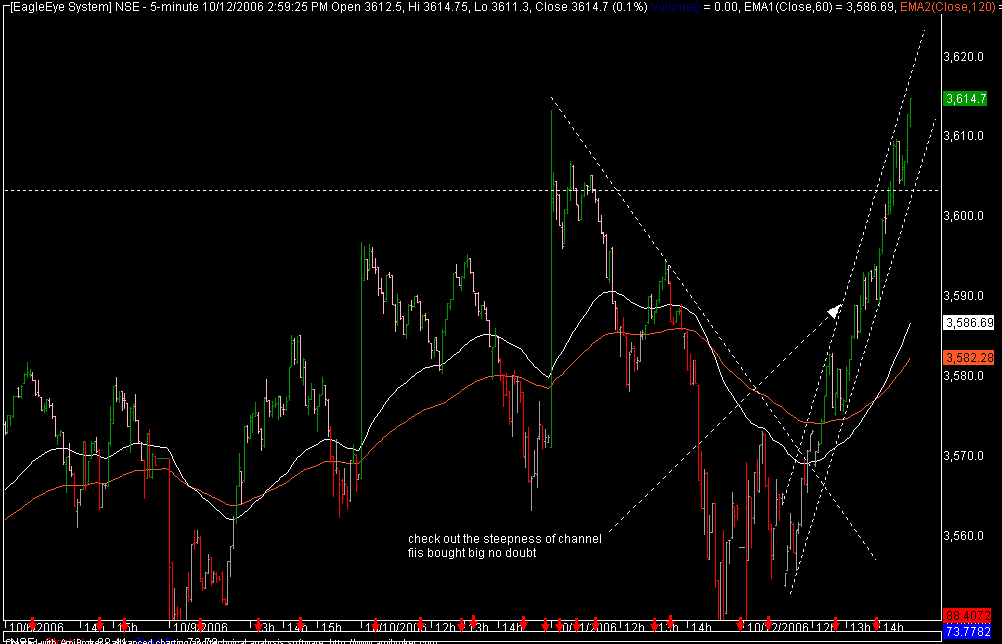

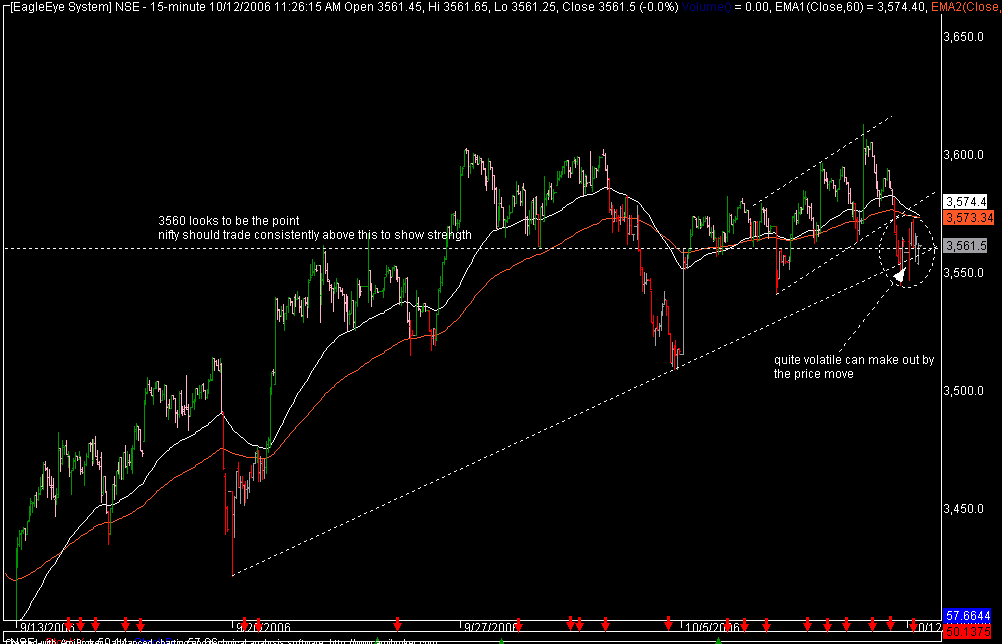

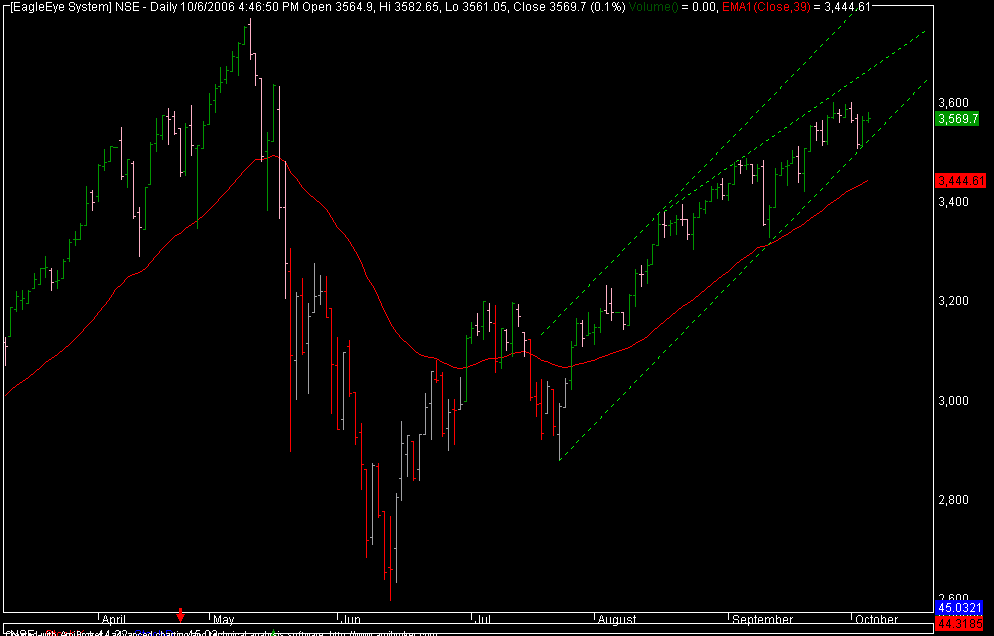

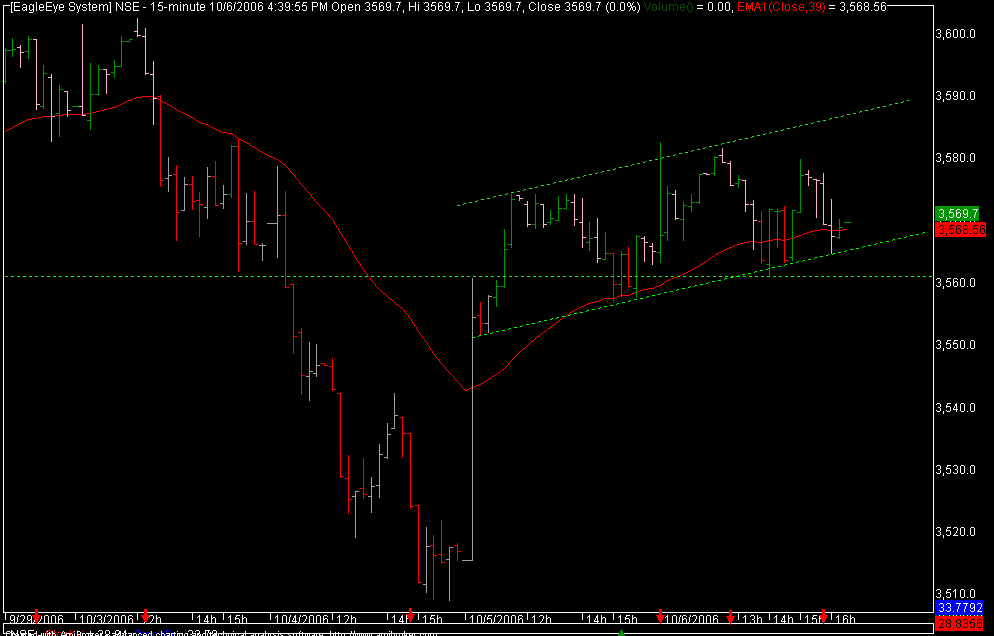

NIFTY VIEW

First chart shows nifty daily which shows that 3540-45 is crucial level so keep an eye on it as long as that level is maintained on a closing basis we are safe

second chart is 15 min intra which shows nifty in a channel and nifty took support and trying to move up intraday nifty is strong above 3560 and will be weak below 3540

cheers

rish

Sunday, October 08, 2006

BINDAL AGRO

BALRAMPUR CHINNI

praj industries

Saturday, October 07, 2006

Averaging Down - Good Idea or Foolish Risk?

Averaging down is a strategy to lower your average cost in a stock that has dropped in price. Is this a good idea or throwing good money after bad?

Averaging down is a strategy to lower your average cost in a stock that has dropped in price. Is this a good idea or throwing good money after bad?The answer depends on several factors. First, let me describe how it works. You buy 500 shares at $50 per share, but the stock drops to $46 per share. You then buy another 500 shares at $46 per share, which lowers your average price to $48 per share.

Admittedly, this is a simple example, but you get the idea.

Good Strategy or Bad?

Now, is this a good strategy or not? If the stock rebounds to $60 per share, then it was a great strategy. However, if the stock continues falling, you have to decide to keep averaging down or bail out and take a loss.Which brings us back to the question, is averaging down a good strategy or not? Before we can answer that question, we need to decide if we are investing in a stock or a company. he distinction is very important.

Investing in Stock

If you are investing in a stock, you look for buy and sell signals based on a number of indicators. Your goal is to make money on the trade and you have no real interest in the underlying company other than how it might be affected by market, news or economic changes.

In most cases, you don’t know enough about the underlying company to determine if a drop in price is temporary or a reflection of a serious problem.Your best course of action when investing in a stock (as opposed to a company) is to cut your losses at no more than 7%. When the stock drops that much, sell and move on to the next deal.

Investing in a Company

If you are investing in a company (as opposed to a stock), you have done your homework and know what’s going on within the firm and its industry. You should know if a drop in the stock’s price is temporary or sign of trouble.If you truly believe in the company, averaging down may make sense if you want to increase your holdings in the company. Accumulating more stock at a lower price makes sense if you plan to hold it for a long period.

This is not a strategy you should employ lightly. If there is a heavy volume of selling against the company, you may want to ask yourself if they know something you don’t. The “they” is this case will almost certainly be mutual funds and institutional investors.

Swimming against the current can sometimes prove profitable, but it can also get you swept over the waterfall.

Conclusion

If you’re playing stocks, averaging down probably doesn’t make any sense. Take a small loss before it becomes a big loss and move on to the next trade.If you invest in companies, averaging down may make sense if you want to accumulate more shares and are convinced the company is fundamentally sound.

Friday, October 06, 2006

Subscribe to:

Posts (Atom)