Hi friends,

Ultratech is looking to come out of a squeeze which is happening for some time

lets look at the Ultratech Technical chart,

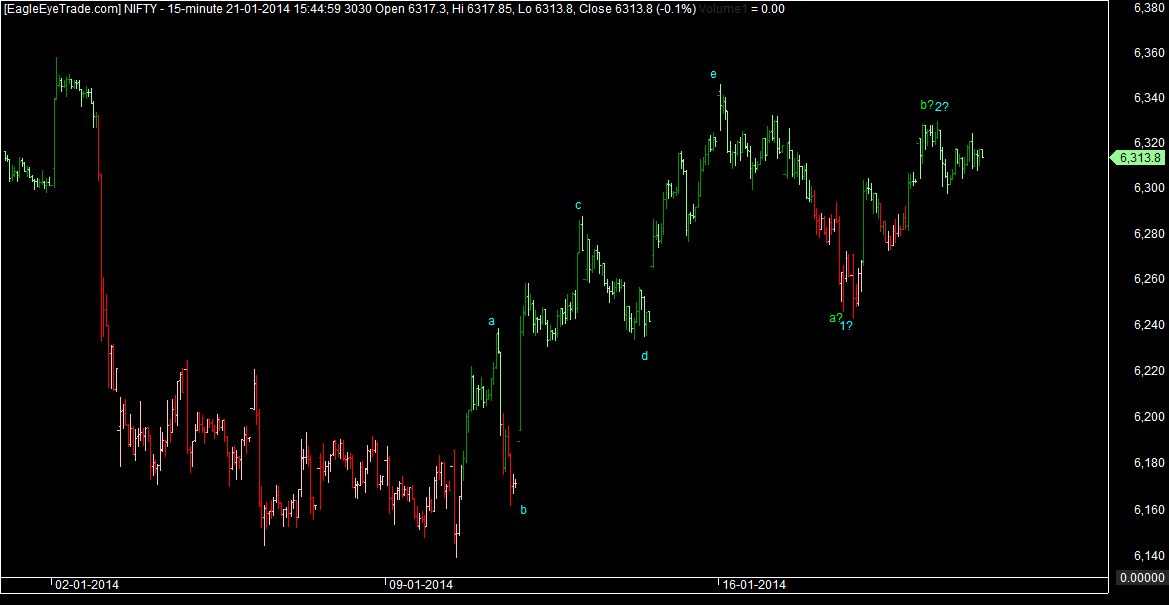

Looking at the chart we can easily see it finished a wxy at 1634.From there we had a nice A or 1 up

and then a correction started for the rise,In correction i see every leg has got 3 waves so

a kind of squeeze or triangle underway.

Lets look at the squeeze closely.

So this stock has potential to go towards 1780 provided 1660 holds.

So here we have a nice swing trade setop buy in range 1680-85

stoploss neat 1660 and target 1780 .

Need to be carefull neat 1710-1720 reason once thats crossed 1780 would be

coming soon.

Regards

Rish

Ultratech is looking to come out of a squeeze which is happening for some time

lets look at the Ultratech Technical chart,

Looking at the chart we can easily see it finished a wxy at 1634.From there we had a nice A or 1 up

and then a correction started for the rise,In correction i see every leg has got 3 waves so

a kind of squeeze or triangle underway.

Lets look at the squeeze closely.

So this stock has potential to go towards 1780 provided 1660 holds.

So here we have a nice swing trade setop buy in range 1680-85

stoploss neat 1660 and target 1780 .

Need to be carefull neat 1710-1720 reason once thats crossed 1780 would be

coming soon.

Regards

Rish