Hi friends,

Rechecking the big picture of nifty,Nifty has been sideways uppish for almost 3 months

now sideways up down move with continuous falling volumes.Meanwhile the badly battered midcaps rising back,Not an easy market to understand continuous sector rotation.IT has been sideways ,Pharma falling along with FMCG, Banking is been volatile with in between fast up downs,Out of the

heavy weights LT has been on a roll it did 700-1080in matter of 3 months.Reliance has been sideways with in triangle ,ITC has been falling a slow fall along with HUL.

Looking at nifty i am of the opinion we are forming ascending broadening wedge ,With each

leg getting broader and broader towards upside.

The above chart shows my expectation ,If you see the whole broadening pattern has developed on falling volume.We test 6400-6500 and drop back to make a upper

bottom somewhere near 5500-5600 and rise towards 6800-7000.My reading says we can have a fake breakout and then reverse back in broadening channel to test lower trend line and reverse back to make a new high .

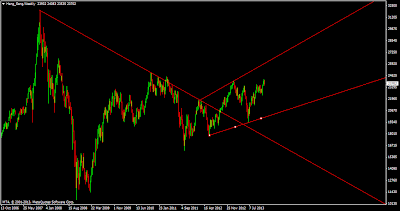

I Track Hangseng closely and its too making the same pattern lets see the chart of hand seng

Quite similar to nifty structure,Overall we should hit upper trendline resitance by january 2014

till then buy all dips for gains ,Be watch full January onwards.

Regards

Rish

Rechecking the big picture of nifty,Nifty has been sideways uppish for almost 3 months

now sideways up down move with continuous falling volumes.Meanwhile the badly battered midcaps rising back,Not an easy market to understand continuous sector rotation.IT has been sideways ,Pharma falling along with FMCG, Banking is been volatile with in between fast up downs,Out of the

heavy weights LT has been on a roll it did 700-1080in matter of 3 months.Reliance has been sideways with in triangle ,ITC has been falling a slow fall along with HUL.

Looking at nifty i am of the opinion we are forming ascending broadening wedge ,With each

leg getting broader and broader towards upside.

The above chart shows my expectation ,If you see the whole broadening pattern has developed on falling volume.We test 6400-6500 and drop back to make a upper

bottom somewhere near 5500-5600 and rise towards 6800-7000.My reading says we can have a fake breakout and then reverse back in broadening channel to test lower trend line and reverse back to make a new high .

I Track Hangseng closely and its too making the same pattern lets see the chart of hand seng

Quite similar to nifty structure,Overall we should hit upper trendline resitance by january 2014

till then buy all dips for gains ,Be watch full January onwards.

Regards

Rish

stockgrit.com welcoms you to post your technical analysis on our website where more traders are connected to share and gain from the analysis from different chartists like you.

ReplyDelete