Hi friends,

February series ended on a high .I had posted a expiry View Nifty expiry.

Nifty expired on said direction,Now a new series in on lets see how waves unfold.

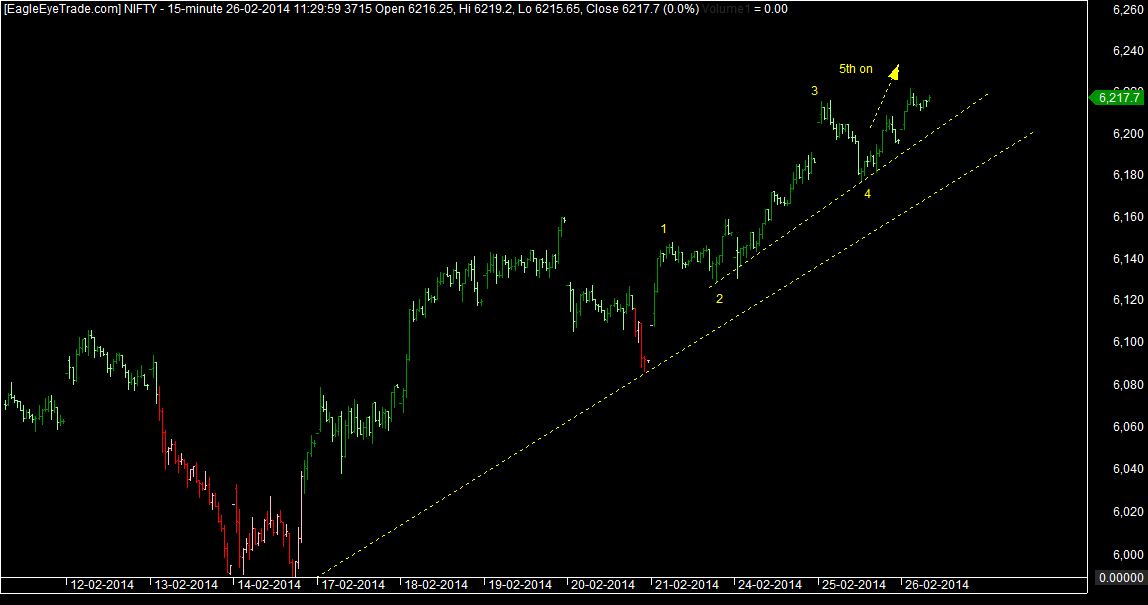

Lets look at the present chart structure.

We are in 5th of

impulse of lower

degree and it can end

anytime.The options

we have according to

elliottwave is shown

in the chart.

Lets look at the lower

time frame chart

to have a better look

at the structure.

As long as nifty remains

above 6215 it seems fine.

Below 6215 first sign of

weakness .Below 6160

trend would get negative

else we can rise back

from 6160 .Lets see how

nifty behaves in next

few days it would

show the roadmap

for next few weeks .

Regards

Rish

February series ended on a high .I had posted a expiry View Nifty expiry.

Nifty expired on said direction,Now a new series in on lets see how waves unfold.

Lets look at the present chart structure.

We are in 5th of

impulse of lower

degree and it can end

anytime.The options

we have according to

elliottwave is shown

in the chart.

Lets look at the lower

time frame chart

to have a better look

at the structure.

As long as nifty remains

above 6215 it seems fine.

Below 6215 first sign of

weakness .Below 6160

trend would get negative

else we can rise back

from 6160 .Lets see how

nifty behaves in next

few days it would

show the roadmap

for next few weeks .

Regards

Rish