Hi friends,

Today i would try to count elliott waves of HDFC bank.

This is super heavy weight in Nifty as well as bank nifty.

So knowing about this movement helps much in nifty movement.

Lets see the chart of HDFC BANK.

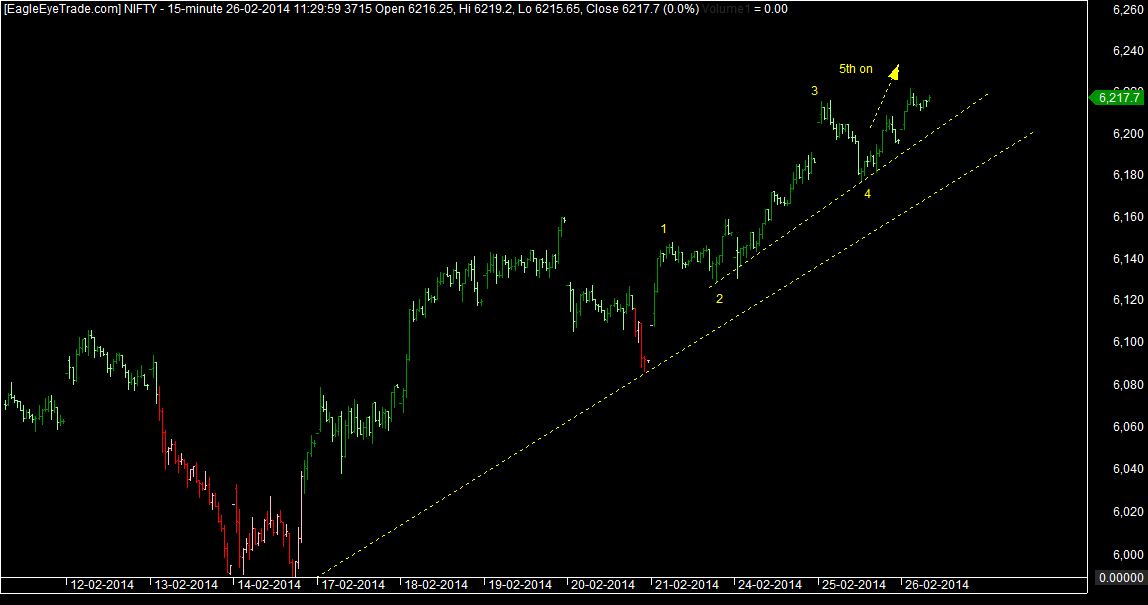

We can see from the chart

my expectation wave wise.

I think we are in e leg of

larger degree wedge or

diagonal.

As long as the stock holds

above 650 a rise towards

700-720 is open ,We should

have a dip coming in from

680-690 levels towards

650 making b wave after a .Lets see how stock moves in coming days.

Regards

Rish

Today i would try to count elliott waves of HDFC bank.

This is super heavy weight in Nifty as well as bank nifty.

So knowing about this movement helps much in nifty movement.

Lets see the chart of HDFC BANK.

We can see from the chart

my expectation wave wise.

I think we are in e leg of

larger degree wedge or

diagonal.

As long as the stock holds

above 650 a rise towards

700-720 is open ,We should

have a dip coming in from

680-690 levels towards

650 making b wave after a .Lets see how stock moves in coming days.

Regards

Rish