Volatility Index is a measure of market’s expectation of volatility over the

near term.

India VIX is a volatility index based on the NIFTY Index Option prices. From the best bid-ask prices of NIFTY Options contracts, a volatility figure (%) is calculated which indicates the expected market volatility over the next 30 calendar days. India VIX uses the computation methodology of CBOE, with suitable amendments to adapt to the NIFTY options order book using cubic splines, etc.

Recently NSE Starting trading in India vix

Though its costly,Not meant for retail investors: The contract value would be minimum Rs. 10 lakh, so is unlikely to be evoke interest from retail investors.

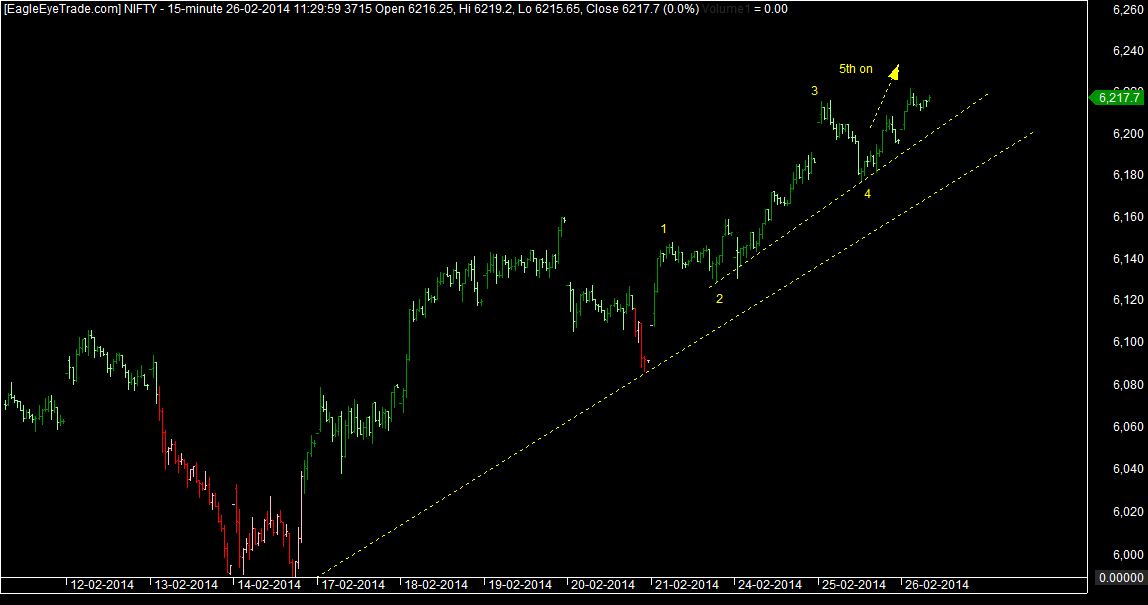

Lets see the India VIX chart.

From the chart we can see

the vix is forming

abcde and is in ending stage.

It should bottom near 12

and then head towards

16.

Above 16 it would be a

breakout and it can

travel much above

so as of now first hurdle

in rise would be 16.

Regards

Rish

India VIX is a volatility index based on the NIFTY Index Option prices. From the best bid-ask prices of NIFTY Options contracts, a volatility figure (%) is calculated which indicates the expected market volatility over the next 30 calendar days. India VIX uses the computation methodology of CBOE, with suitable amendments to adapt to the NIFTY options order book using cubic splines, etc.

Recently NSE Starting trading in India vix

Though its costly,Not meant for retail investors: The contract value would be minimum Rs. 10 lakh, so is unlikely to be evoke interest from retail investors.

Lets see the India VIX chart.

From the chart we can see

the vix is forming

abcde and is in ending stage.

It should bottom near 12

and then head towards

16.

Above 16 it would be a

breakout and it can

travel much above

so as of now first hurdle

in rise would be 16.

Regards

Rish