Buy low, sell high. Short high, cover low. Traders are like surfers,

trying to catch good waves, only their beach is rocky, not sandy.

Professionals wait for opportunities but amateurs jump in, driven by

emotions—they keep buying strength and selling weakness, bleeding

their equity into the markets.

Buy low, sell high sounds like a simplerule, but greed and fear can override the best intentions.A professional waits for familiar patterns to emerge from the market.

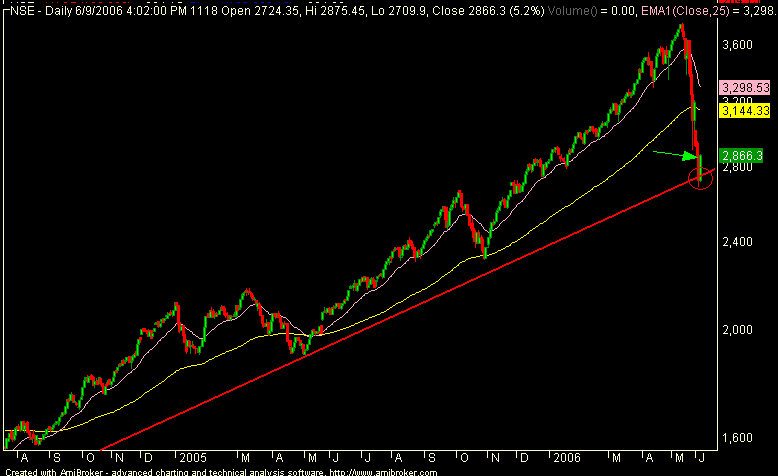

He may notice a new trend with rising momentum, indicating higher

prices ahead. Or he may detect the feebleness of momentum during a

rally, indicating weakness. Once he recognizes a pattern, he puts on

a trade. He has a clear notion of how he’ll get in, where he’ll take profits,

and where he’ll accept a loss if the market turns against him.

A trade is a bet on a price change, but there is a paradox. Each price

reflects the latest consensus of value of market participants. Putting on

a trade challenges that consensus. A buyer disagrees with the collective

wisdom by saying the market is underpriced. A seller disagrees with the

wisdom of the entire group, believing the market is overpriced. Both

the buyer and the seller expect the consensus to change, but meanwhile

they defy the market. That market includes some of the most brilliant

minds and some of the deepest pockets on Earth. Arguing with this

group is dangerous business, and it has to be done very cautiously.

An intelligent trader looks for holes in the efficient market theory.

He scans the market for brief periods of inefficiency. When the crowd

is gripped by greed, the newcomers jump in and load up on stocks.

When falling prices squeeze the fingers of thousands of buyers, they

dump their holdings in a panic, disregarding fundamental values. Those

episodes of emotional behavior dilute the cold efficiency of the market,

creating opportunities for disciplined traders. When markets are

calm and efficient, trading becomes a crapshoot, with commissions and

slippage worsening the odds.

Crowd mentality changes slowly, and price patterns recur, albeit

with variations.

Emotional swings provide trading opportunities, while

efficient markets chop up and down, offering no edge to traders, only

piling up their costs. Technical analysis tools will work for you only if

you have the discipline to wait for patterns to emerge. Professionals

trade only when markets offer them special advantages.