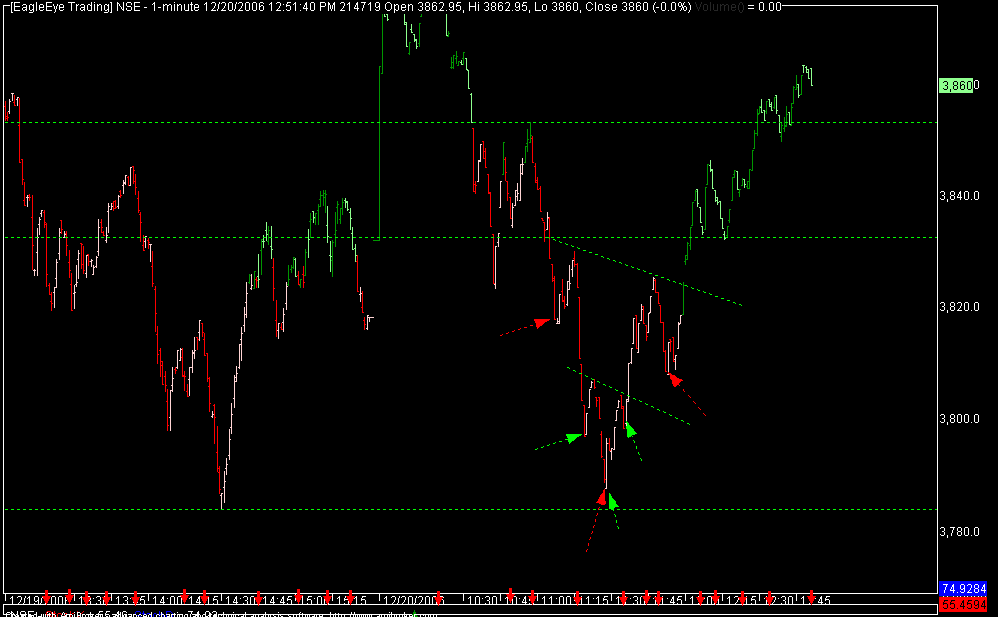

nifty rose from bottom with two IHS shown with green and red arrows

With reference to circulars no NSE/F&O/0014/2001 dated June 29, 2001, NSE/F&O/00272001 dated November 07, 2001, SEBI circular SMDRP/DNPD/CIR -26/2004/07/16 dated July 16, 2004, and approval received from SEBI, members are hereby notified that the following additional securities will be available for trading in F&O segment with effect from December 29, 2006 :

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Skeptics of the stock market rally never tire of pointing out that only a handful of shares have participated in the recovery between June till now.

Skeptics of the stock market rally never tire of pointing out that only a handful of shares have participated in the recovery between June till now.  anies whose bottomlines slipped into the red during this period.

anies whose bottomlines slipped into the red during this period.The Kolkata-based company plans to sell ``fast-moving consumer goods,'' Chairman Y.C. Deveshwar told reporters in New Delhi today, without specifying the products or by when it plans to start selling the new products.

ITC, set up in 1910, has in the past six years added businesses such as food, matches, apparel, deodorants, greeting cards and rural retail stores to reduce its reliance on tobacco, which contributes to about half of sales. Analysts such as Abhijeet Kundu expect ITC to start selling soaps and detergents, putting it in direct competition with the local units of Unilever and Procter & Gamble Co.

``It may turn out to be a good move in the long term but may delay the projected breakeven of its non-tobacco business because of higher advertisement spending,'' said Kundu, an analyst with Prabhudas Lilladher Securities in Mumbai, who has a ``buy'' rating on ITC stock. ``The introduction of soaps and detergents may hurt Hindustan Lever in the long term.''

Stock Performance

Shares of ITC fell 5.8 rupees, or 3.3 percent, to 168.35 rupees at the close on the Bombay Stock Exchange. The exchange's benchmark Sensitive Index declined 2.5 percent today.

ITC, 32 percent owned by British American Tobacco Plc, is aiming to exploit the access it has to shops in the nation's 4,378 towns and 638,000 villages to sell products ranging from food to match boxes.

``It is our objective to strive to gain a position of leadership not only in areas we have already entered but newer areas,'' Deveshwar said. ``Our people are hard at work. Our product development, our research and development activity is working round the clock.''

In July 2005, ITC started selling perfumes and deodorants.

ITC plans to set up fresh-food stores in 54 locations in the country over the next three years, Deveshwar said. ITC opened its first fresh-food store, called Choupal Fresh, in August in the southern Indian city of Hyderabad.

The company has set up a network of 6,400 Internet kiosks called e-Choupals and 11 supermarkets called Choupal Sagars. The e-Choupals give farmers access to a company Web site where they can see prices of agricultural produce, browse for new seeds or equipment and check the weather.

The Choupal Sagars buy farm produce and offer a range of services such as soil testing and advice to farmers on new farming practices, buying produce from cultivators and selling them a range of products such as toothpastes and mobile phones.