Monday, December 04, 2006

RETAIL BATTEL GROUND

Wal-Mart’s surprise entry into India through the franchisee route may be followed by at least two more big  deals, comprising of Tesco and Carrefour, early next year. According to industry sources, while Carrefour is giving final touches to a similar agreement with the Landmark group, Tesco will also be working out something, now that its talks with Bharti have fallen through.

deals, comprising of Tesco and Carrefour, early next year. According to industry sources, while Carrefour is giving final touches to a similar agreement with the Landmark group, Tesco will also be working out something, now that its talks with Bharti have fallen through.

However, with franchising fast emerging as the favourite India entry vehicle for international retail chains, not everyone is in celebration mode. Experts feel that for most single bran ds having just a 51% stake, does not make good business sense.

ds having just a 51% stake, does not make good business sense.

Particularly, when the franchisee option is available, where capital investment is not required. For foreign labels like Tommy Hilfiger, US-based VF Corporation’s brands like Lee, Wrangler, Kipling, Nautica and Jansport, and others such as Tag Heuer, Louis Vuitton, Hugo Boss, Mothercare, Chanel, Gant, Guess, either don’t have a global policy to invest in their own retail chains or wouldn’t like to change the existing franchisee arrangement and go for JVs, for lack of critical mass.

Some of the prominent brands that are in talks with Indian partners include Armani, Banana Republic, Carrera, Cerruti, Valentino and Lalique. These companies have been talking to Indian companies such as Reliance, Tata-promoted Trent and DLF.

Even those brands, which could be looking at investing in India such as Gap, Zara, Ralph Lauren, Old Navy and Ba nana Republic, would rather wait for the sector to allow 100% FDI, because their philosophy is to sell their respective brands strictly through company-owned exclusive retail stores.

nana Republic, would rather wait for the sector to allow 100% FDI, because their philosophy is to sell their respective brands strictly through company-owned exclusive retail stores.

However, many players are upbeat too. Some deals have actually fructified, and the brands that have come via 51% FDI claim that they are quite satisfied with the retail scenario in India.

LVMH has already set up shop in India. Lee Cooper has forged a JV with Pantaloon Retail. Dubai-based jewellery retailers Damas, has entered India in a tie up with Gold Souk.

deals, comprising of Tesco and Carrefour, early next year. According to industry sources, while Carrefour is giving final touches to a similar agreement with the Landmark group, Tesco will also be working out something, now that its talks with Bharti have fallen through.

deals, comprising of Tesco and Carrefour, early next year. According to industry sources, while Carrefour is giving final touches to a similar agreement with the Landmark group, Tesco will also be working out something, now that its talks with Bharti have fallen through.However, with franchising fast emerging as the favourite India entry vehicle for international retail chains, not everyone is in celebration mode. Experts feel that for most single bran

ds having just a 51% stake, does not make good business sense.

ds having just a 51% stake, does not make good business sense.Particularly, when the franchisee option is available, where capital investment is not required. For foreign labels like Tommy Hilfiger, US-based VF Corporation’s brands like Lee, Wrangler, Kipling, Nautica and Jansport, and others such as Tag Heuer, Louis Vuitton, Hugo Boss, Mothercare, Chanel, Gant, Guess, either don’t have a global policy to invest in their own retail chains or wouldn’t like to change the existing franchisee arrangement and go for JVs, for lack of critical mass.

Some of the prominent brands that are in talks with Indian partners include Armani, Banana Republic, Carrera, Cerruti, Valentino and Lalique. These companies have been talking to Indian companies such as Reliance, Tata-promoted Trent and DLF.

Even those brands, which could be looking at investing in India such as Gap, Zara, Ralph Lauren, Old Navy and Ba

nana Republic, would rather wait for the sector to allow 100% FDI, because their philosophy is to sell their respective brands strictly through company-owned exclusive retail stores.

nana Republic, would rather wait for the sector to allow 100% FDI, because their philosophy is to sell their respective brands strictly through company-owned exclusive retail stores.However, many players are upbeat too. Some deals have actually fructified, and the brands that have come via 51% FDI claim that they are quite satisfied with the retail scenario in India.

LVMH has already set up shop in India. Lee Cooper has forged a JV with Pantaloon Retail. Dubai-based jewellery retailers Damas, has entered India in a tie up with Gold Souk.

TCS bags $100mn Bank of China deal

IT major Tata Consultancy Services (TCS) has won a landmark deal worth a whopping $100 million from the state-run Bank of China (BOC), industry sources said today.

It is being dubbed as one of the major IT-related deals signed by a Chinese bank ahead of the opening up of the country's banking sector to foreign competition by December 11 under Beijing's commitment to the World Trade Organisation (WTO), industry sources said.

"It is a major breakthrough for Indian IT companies, who are aggressively expanding their operations and bidding for government contracts in China," a software expert said.

Under the just-inked deal, the Indian IT giant will provide a range of banking solutions to BOC. However the details are not yet known.

All major Indian IT giants, including TCS, Infosys, Satyam, Wipro, NIIT, and i-flex have set up bases in China, servicing their multinational customers in the country and targeting the huge domestic software market as well as the Japanese and South Korean markets.

Meanwhile, TCS and its Chinese partners are expected to get their business licence soon for their Beijing-based joint venture, another milestone in the company's bid to expand its global footprint.

The joint venture company will be located in Beijing's Zhongguancun Software Park (z-Park) and will provide IT services and solutions to China's domestic market as well as other major markets like Japan, the rest of Asia-Pacific region, US, and Europe.(PTI)

It is being dubbed as one of the major IT-related deals signed by a Chinese bank ahead of the opening up of the country's banking sector to foreign competition by December 11 under Beijing's commitment to the World Trade Organisation (WTO), industry sources said.

"It is a major breakthrough for Indian IT companies, who are aggressively expanding their operations and bidding for government contracts in China," a software expert said.

Under the just-inked deal, the Indian IT giant will provide a range of banking solutions to BOC. However the details are not yet known.

All major Indian IT giants, including TCS, Infosys, Satyam, Wipro, NIIT, and i-flex have set up bases in China, servicing their multinational customers in the country and targeting the huge domestic software market as well as the Japanese and South Korean markets.

Meanwhile, TCS and its Chinese partners are expected to get their business licence soon for their Beijing-based joint venture, another milestone in the company's bid to expand its global footprint.

The joint venture company will be located in Beijing's Zhongguancun Software Park (z-Park) and will provide IT services and solutions to China's domestic market as well as other major markets like Japan, the rest of Asia-Pacific region, US, and Europe.(PTI)

Sunday, December 03, 2006

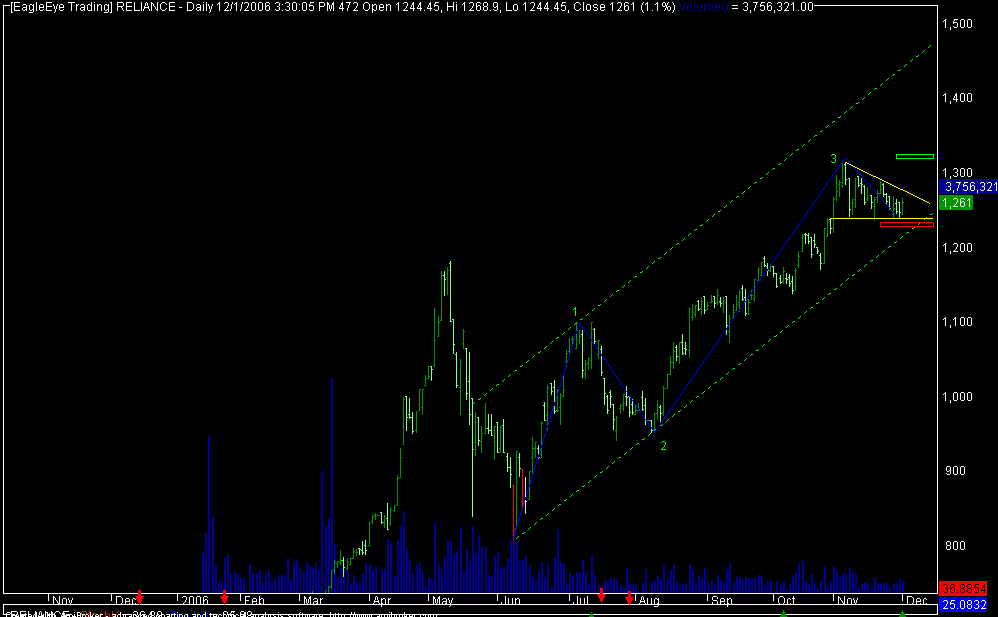

RELIANCE

Subscribe to:

Posts (Atom)