HI

Following are few questions put forward read them and tick the appropriate option lets understand the mentality of people around and their style of trading and get benefited.

cheers.

Saturday, September 09, 2006

Friday, September 08, 2006

When is the Best Time to Sell a Stock?

When is a good time to sell a stock?

* The Stock Drops by x%

If you buy a stock as a trader, rather than an investor you may set an arbitrary floor for the stock. When the stock falls to this floor, you sell. Many traders set that floor in the 6% – 8% range, depending on the volatility of the stock.# They may not be happy about a small loss, but they make sure it doesn’t become a big loss.

# The Company Flounders

This is the investor’s signal to sell. The investor bought the company because of its fundamentals and its business plan. When something changes and the company loses its way, the investor has to re-examine whether it is the same company or not. Maybe a new CEO takes the company off in a direction that the investor (and market) believes is wrong.

# When a Stock is Over Valued

Can there be too much of a good thing? There certainly can in the market. When stocks are pushed way past their true value, they are often set up for a fall. The strategy is to sell when they are over valued and buy them back after a market correction has knocked the price back down. This, of course presumes an accurate knowledge of the top and bottom of prices – something very few of us are particularly good at with any consistency. Selling an over-valued stock is certainly preferable to buying an over-valued stock. Just be prepared to watch it keep going up after you sell, as happens sometimes. Don’t second-guess yourself; it could have more easily gone the other way.

be too much of a good thing? There certainly can in the market. When stocks are pushed way past their true value, they are often set up for a fall. The strategy is to sell when they are over valued and buy them back after a market correction has knocked the price back down. This, of course presumes an accurate knowledge of the top and bottom of prices – something very few of us are particularly good at with any consistency. Selling an over-valued stock is certainly preferable to buying an over-valued stock. Just be prepared to watch it keep going up after you sell, as happens sometimes. Don’t second-guess yourself; it could have more easily gone the other way.

# Rebalancing Your Portfolio

You have decided that the best allocation for your circumstances is 60% stocks, 30% bonds and 10% cash in your portfolio. Good fortune has smiled on you and your stocks, which are now valued at 70% of your portfolio. As tempting as it might be, your best move is to rebalance your portfolio by selling off some of your stocks and bringing the percentages back into alignment. Obviously, the stock(s) you sell should meet the long-term capital gains test of one-year ownership. Beyond that, look at how your stocks break out and decide which stocks can be sold to keep the diversification intact.

Conclusion

There may be other market-driven reasons to sell that are just as valid as these are. Always consider the consequences (transaction costs, taxes, etc.) before making any decision to sell.

* The Stock Drops by x%

If you buy a stock as a trader, rather than an investor you may set an arbitrary floor for the stock. When the stock falls to this floor, you sell. Many traders set that floor in the 6% – 8% range, depending on the volatility of the stock.# They may not be happy about a small loss, but they make sure it doesn’t become a big loss.

# The Company Flounders

This is the investor’s signal to sell. The investor bought the company because of its fundamentals and its business plan. When something changes and the company loses its way, the investor has to re-examine whether it is the same company or not. Maybe a new CEO takes the company off in a direction that the investor (and market) believes is wrong.

# When a Stock is Over Valued

Can there

be too much of a good thing? There certainly can in the market. When stocks are pushed way past their true value, they are often set up for a fall. The strategy is to sell when they are over valued and buy them back after a market correction has knocked the price back down. This, of course presumes an accurate knowledge of the top and bottom of prices – something very few of us are particularly good at with any consistency. Selling an over-valued stock is certainly preferable to buying an over-valued stock. Just be prepared to watch it keep going up after you sell, as happens sometimes. Don’t second-guess yourself; it could have more easily gone the other way.

be too much of a good thing? There certainly can in the market. When stocks are pushed way past their true value, they are often set up for a fall. The strategy is to sell when they are over valued and buy them back after a market correction has knocked the price back down. This, of course presumes an accurate knowledge of the top and bottom of prices – something very few of us are particularly good at with any consistency. Selling an over-valued stock is certainly preferable to buying an over-valued stock. Just be prepared to watch it keep going up after you sell, as happens sometimes. Don’t second-guess yourself; it could have more easily gone the other way.# Rebalancing Your Portfolio

You have decided that the best allocation for your circumstances is 60% stocks, 30% bonds and 10% cash in your portfolio. Good fortune has smiled on you and your stocks, which are now valued at 70% of your portfolio. As tempting as it might be, your best move is to rebalance your portfolio by selling off some of your stocks and bringing the percentages back into alignment. Obviously, the stock(s) you sell should meet the long-term capital gains test of one-year ownership. Beyond that, look at how your stocks break out and decide which stocks can be sold to keep the diversification intact.

Conclusion

There may be other market-driven reasons to sell that are just as valid as these are. Always consider the consequences (transaction costs, taxes, etc.) before making any decision to sell.

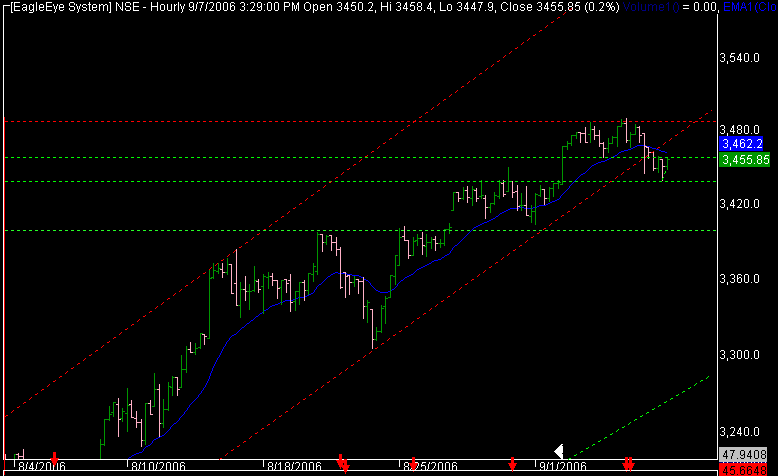

NIFTY SEP 08

THE above chart of nifty shows it has violated a small channel in which it was moving since 3140 levels. 3435-37 and 3410-3400 are supports towars downside on upside nifty finds congestion at 3457-60 and then at 3487,buy your choice stocks as nifty approaches its supports.Try not to be too aggressive.

cheers

rish

Subscribe to:

Comments (Atom)