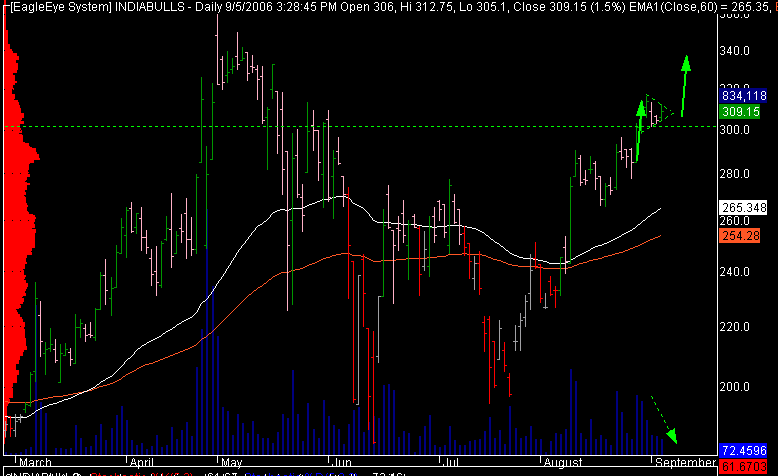

Falling stock prices are sometimes a hard pill to swallow but long-term investors shouldn't be concernedMany investors have a hard time dealing with falling stock prices but for the wrong reasons. No matter how often you preach the virtues of the buy-and-hold method, the true test of courage comes when you watch

your holdings nose dive twenty percent in one afternoon.

Anyone who has been through a bear market knows that it takes tremendous discipline and dedication to stick to your guns while everyone else liquidates their holdings. Plagued by images of depression, recession, and corporate layoffs, manic Wall Street becomes a breeding ground for chaos and faulty logic. Perfectly good companies begin selling for fractions of their true value, despite a lack of change in the long-term economics of the business.

Here are three fundamental truths that will help you deal with short-term market losses.

Truth One: You own a business, not a stockWhat you are holding in your portfolio is a piece of a business, not a stock. Investors who purchase shares of stock simply because they are going "up" or are going to be the "next big thing" are essentially gamblers. They buy a commodity with the belief (rational or not) that the next person in line will pay a higher price for it than they did. The problem is, this cycle can't go on forever, and at some point, someone is going to look around, realize what happened, and bail ship.

In order to be a successful investor you must do two things. First, remove all emotions from each of your financial decisions. Romeo and Juliet were terrific lovers, but not very logical people (and look where that got them). Letting your heart and emotions impact your actions is foolish in most circumstances, deadly in economic ones. Second, learn to separate the underlying business from the stock price; they are not the same thing (read that again). You've heard it said a million times; even a great company is a lousy investment if you pay too much for it.

Truth T wo: If you are a long-term investor, falling prices are a blessing

wo: If you are a long-term investor, falling prices are a blessingThe only time a bear market is bad for you is when you need your money immediately. For those who are investing with a time frame of ten or more years, declining prices represent only one thing: the opportunity to buy more of their favorite company at a lower price. It's kind of like a giant garage sale where the lady of the house decides she wants new drapes and, as a result, decides to sell all of her living room furniture for half price. It doesn't have to make sense to the buyer. Indeed, a smart one would jump at the opportunity. All too often, investors try to convince the woman that she shouldn't be selling her coffee table to them for so cheap.

Truth Three: It doesn't matterMost of the investment crowd will fight it, but it's true. In the end, your pocketbook really isn't what matters. Think back to the time before you owned any investments. You were still alive then, right? You could still have a good time? You still had friends?Money is literally a piece of colored paper with the picture of a dead person on it. Bottom line. Society has assigned value to it, so we accept it, and it can be a very powerful tool in our lives. You must never make it an end unto itself. Wealth can never be the "goal". It is the means by which we accomplish things. It's like owning a hammer - no sane person wants to own the hammer for the sake of "owning it" - they want it for what it can do. It can build and create. That's the goal of prosperity; to attain the financial freedom to provide a better life for yourself, your family, and everyone with whom you come in contact. If you make the pursuit of riches your highest goal in life, you will feel miserable and empty.Your blessings, gifts, and finances only realize their true value when you give them. The guaranteed way to feel wealthier is to give what you already have. You see the joy it can bring others. The feeling of generosity and happiness that comes with giving is true wealth.

your holdings nose dive twenty percent in one afternoon.

your holdings nose dive twenty percent in one afternoon. wo: If you are a long-term investor, falling prices are a blessing

wo: If you are a long-term investor, falling prices are a blessing