A beginner entering the markets soon finds himself surrounded by a colorful

crowd of gurus—experts who sell trading advice. Most charge fees,

but some give advice for free to drum up business for their brokerage

firms some give for fun some for hype but very few you will find who are

genuine. Gurus publish newsletters, are quoted in the media, and many

would kill to get on TV. Masses are hungry for clarity, and gurus are

there to feed that hunger. Most are failed traders, but being a guru is not

that easy. Their mortality rate is high, and few stay around for more than

two years. The novelty wears off, customers do not renew subscriptions,

and a guru finds it easier to earn a living selling aluminum siding than

drawing trendlines.Traders go through three stages in their attitudes

towards gurus.

In the beginning, they drink in their advice, expecting to make money

from it. At the second stage, traders start avoiding gurus like the

plague, viewing them as distractions from their own decision-making

process. Finally, some successful traders start paying attention to a few

gurus who alert them to new opportunities.

Some losing traders go looking for a trainer, a teacher, or a therapist.

Very few people are experts in both psychology and trading. I’ve met

several gurus who couldn’t trade their way out of a paper bag but

claimed that their alleged expertise in psychology qualified them to

train traders. A teacher who does not trade is highly suspect.

Traders go through several stages in their attitudes towards tips.

Beginners love them, those who are more serious insist on doing their

own homework, while advanced traders may listen to tips but always

drop them into their own trading systems to see whether that advice

will hold up. Whenever I hear a trading tip, I run it through my own

computerized screens. The decision to buy, go short, or stand aside is

mine alone, with an average yield of one tip accepted out of every 20

heard. Tips draw my attention to opportunities I might have overlooked,

but there are no shortcuts to sweating your own trades

Being an analyst is a hard job but being a trader is

more harder.BOTOMLINE:-never trade blindly on anyones call

cheers

Friday, June 23, 2006

CLASS STUFF (much ahead of herd metality)

Just check this guy out hes amazing and consistent in performing

this was todays news letter posted in morning

Daily Report June 23rd, 2006 Friday A.K.Prabhakar

Nifty (2994) SUPPORT-2956-2932-2905 RESISTANCE-3019-3070-3112 nifty staying above 3019 for a long time would be very bullish otherwise we would see some profit booking before any major upmove. F&O settlement jus 5trading days away so till 2860 is not broken we would move to higher levels and any close above 3070-3091 would be good on weekly basis. TOP 5GAINERS=HDFC-LT-NATIONALUM-M&M-PNB TOP5LOSER=DRREDDY-HCLTECH-RANBAXY-BHARTIARTL-IPCL. P/E=17.03 p/b=4.32 adv=45 dec=5 NSE adv: 794 dec: 134 -vol-rs.6477crs

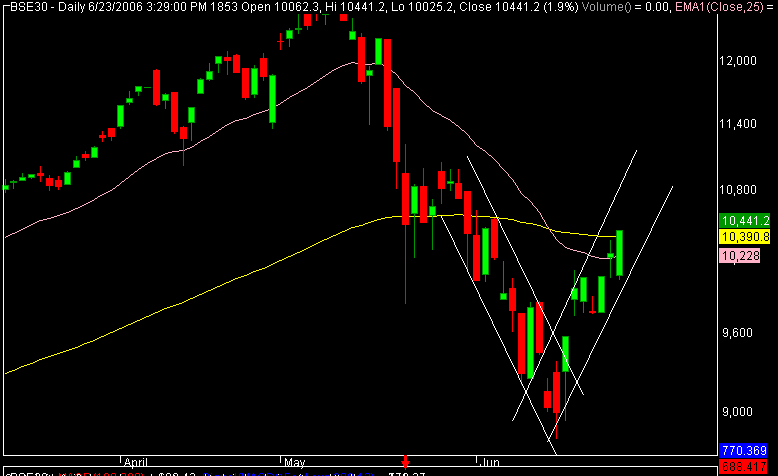

Sensex (10275) SUPPORT-10182-10095-9964 RESISTANCE-10369-10452-10584 Sensex above 10182 would be bullish and a strong resistance would come near 10700 levels only. Today Sensex opened with a gap and now 10054 would become a strong support so one can hold long position till this is not broken now on a weekly close 10452 above close would be highest in 4week in weekly charts and close above 10500-10560 would mean a clear trend reversal in weekly charts.

8dma=9694 13dma=9681 21dma=10004 34dma=10662 55dma=11119 OPEN=10093 HIGH=10362 LOW=10093 BSE adv: 2021 dec: 459 -vol-rs.3262crs

Fiis buyer rs.91crs and Mutual funds buyer rs.97crs on Wednesday, Fiis buyer rs.1199crs in June month and buyer rs.12321Crs in 2006, mutual fund seller rs.2144crs in June month. F&O DATA Fiis buy rs.474crs in nifty future and buy rs.154crs in stock future on 22nd June and provisional Fiis buy in cash rs.23crs source NSE website

Day That Ended: Markets opened higher due to global cues and with many positive news on METALS even the BSE-METAL index has given island reversal suggesting there would be a big upside from here in that sector. BANK as a sector had a good recovery as that was one sector beaten down most HDFC-ICICIBANK-BAJAJAUTO are companies which hold insurance business and these would be the stocks which would see good buying once Fiis are active in India as insurance business has good cash flow. International markets close mixed U.S closed negative and ADRs also closed negative with trend there EURO markets closed positive Asian markets opened negative and CRUDE $71.09

Outlook for Friday: METALS would be the buzz for now TATASTEEL-STER-HINDALCO-HINDZINC-SAIL-NALCO-SESAGOA-GMDC still 7-12% upside left in my view and with news that Korean major Pasco deal in trouble it would be a booster to Indian steel majors. Indian pharma is becoming so hot a property and with MATRIXLAB news investors should understand next TECH boom would be CRAMS in PHARMA so they would be many mergers, takeover in this sector in a longer time to come for now RANBAXY-DRREDDY have seen a big OI built up also. Best picks for next week expiry would be IPCL-BHEL-TATASTEEL-STER-SATYAMCOMP-ACC so any panic close one can add these stocks.

STOCKS: TVSMOTORS-RANBAXY-DRREDDY-PUNJLYOD-POLARIS-BANKINDIA-BOB have a good OI built in F&O so watch.

Counter view: When markets are extremely bullish and market fall many ask when will the markets rise. When markets moves up after major correction many would ask when markets will correct this always show the attitude of the people they almost get it wrong. They never sell when extreme bullishness is seen they wait for a better price to exit and some times they add more and that better price never comes and when there is extreme panic comes they never buy instead they sell there good stocks. In a extreme bull markets all news will look as if markets will touch the sky and in a extreme bearish markets all news would be so bad that as if there is no tomorrow. INFOSYS had given a good guidance nothing has changed in 1month expect for interest rate hike which will not effect this cash rich company and we saw rs.2450 and now 2980 almost 20% in just 10days what more a return does a investor need. This is where emotions comes to play and the best trader and investor who can control his emotion and think differently makes money majority of the times this is very easy said than done as money is at stake.

this was todays news letter posted in morning

Daily Report June 23rd, 2006 Friday A.K.Prabhakar

Nifty (2994) SUPPORT-2956-2932-2905 RESISTANCE-3019-3070-3112 nifty staying above 3019 for a long time would be very bullish otherwise we would see some profit booking before any major upmove. F&O settlement jus 5trading days away so till 2860 is not broken we would move to higher levels and any close above 3070-3091 would be good on weekly basis. TOP 5GAINERS=HDFC-LT-NATIONALUM-M&M-PNB TOP5LOSER=DRREDDY-HCLTECH-RANBAXY-BHARTIARTL-IPCL. P/E=17.03 p/b=4.32 adv=45 dec=5 NSE adv: 794 dec: 134 -vol-rs.6477crs

Sensex (10275) SUPPORT-10182-10095-9964 RESISTANCE-10369-10452-10584 Sensex above 10182 would be bullish and a strong resistance would come near 10700 levels only. Today Sensex opened with a gap and now 10054 would become a strong support so one can hold long position till this is not broken now on a weekly close 10452 above close would be highest in 4week in weekly charts and close above 10500-10560 would mean a clear trend reversal in weekly charts.

8dma=9694 13dma=9681 21dma=10004 34dma=10662 55dma=11119 OPEN=10093 HIGH=10362 LOW=10093 BSE adv: 2021 dec: 459 -vol-rs.3262crs

Fiis buyer rs.91crs and Mutual funds buyer rs.97crs on Wednesday, Fiis buyer rs.1199crs in June month and buyer rs.12321Crs in 2006, mutual fund seller rs.2144crs in June month. F&O DATA Fiis buy rs.474crs in nifty future and buy rs.154crs in stock future on 22nd June and provisional Fiis buy in cash rs.23crs source NSE website

Day That Ended: Markets opened higher due to global cues and with many positive news on METALS even the BSE-METAL index has given island reversal suggesting there would be a big upside from here in that sector. BANK as a sector had a good recovery as that was one sector beaten down most HDFC-ICICIBANK-BAJAJAUTO are companies which hold insurance business and these would be the stocks which would see good buying once Fiis are active in India as insurance business has good cash flow. International markets close mixed U.S closed negative and ADRs also closed negative with trend there EURO markets closed positive Asian markets opened negative and CRUDE $71.09

Outlook for Friday: METALS would be the buzz for now TATASTEEL-STER-HINDALCO-HINDZINC-SAIL-NALCO-SESAGOA-GMDC still 7-12% upside left in my view and with news that Korean major Pasco deal in trouble it would be a booster to Indian steel majors. Indian pharma is becoming so hot a property and with MATRIXLAB news investors should understand next TECH boom would be CRAMS in PHARMA so they would be many mergers, takeover in this sector in a longer time to come for now RANBAXY-DRREDDY have seen a big OI built up also. Best picks for next week expiry would be IPCL-BHEL-TATASTEEL-STER-SATYAMCOMP-ACC so any panic close one can add these stocks.

STOCKS: TVSMOTORS-RANBAXY-DRREDDY-PUNJLYOD-POLARIS-BANKINDIA-BOB have a good OI built in F&O so watch.

Counter view: When markets are extremely bullish and market fall many ask when will the markets rise. When markets moves up after major correction many would ask when markets will correct this always show the attitude of the people they almost get it wrong. They never sell when extreme bullishness is seen they wait for a better price to exit and some times they add more and that better price never comes and when there is extreme panic comes they never buy instead they sell there good stocks. In a extreme bull markets all news will look as if markets will touch the sky and in a extreme bearish markets all news would be so bad that as if there is no tomorrow. INFOSYS had given a good guidance nothing has changed in 1month expect for interest rate hike which will not effect this cash rich company and we saw rs.2450 and now 2980 almost 20% in just 10days what more a return does a investor need. This is where emotions comes to play and the best trader and investor who can control his emotion and think differently makes money majority of the times this is very easy said than done as money is at stake.

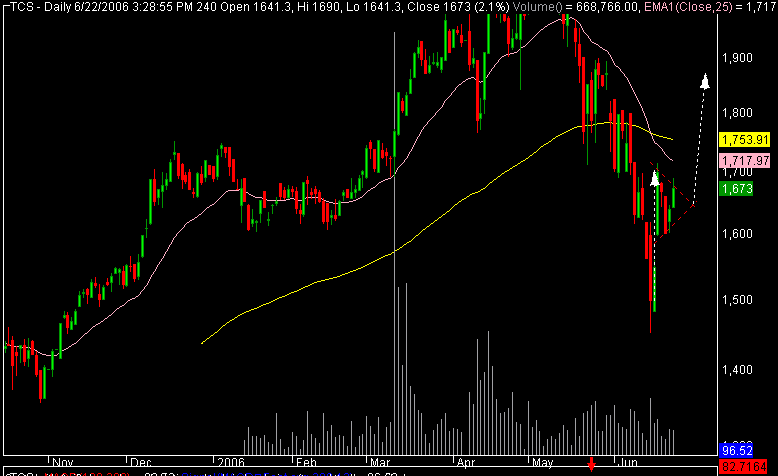

TCS

Subscribe to:

Comments (Atom)