Markets keep changing, and flexibility is the name of the game. A

brilliant programmer told me recently that he kept losing money but

whoever was buying off of his stops must have been profitable because

his stops kept nailing the bottoms of declines. I asked why he didn’t

start placing his buy orders where he now placed stops. He wouldn’t

do it because he was too rigid, and for him buy orders were buy orders

and stops were stops. A high level of education can be a handicap in

trading. Brian Monieson, a noted Chicago trader, once said in an interview,

“I have a Ph.D. in mathematics and a background in cybernetics,

but I was able to overcome those disadvantages and make money.”

Many professional people are preoccupied with being right. Engineers

believe that everything can be calculated, and doctors believe that if

they run enough tests, they’ll come up with the right diagnosis and

treatment. Curing a patient involves a lot more than precision. It is a

running joke how many doctors and lawyers lose money in the markets.

Why? Certainly not for lack of intelligence, but for lack of humility

and flexibility.

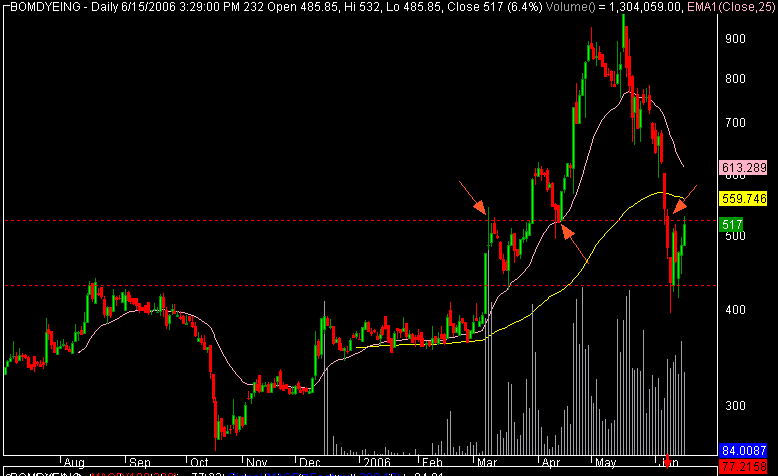

Markets operate in an atmosphere of uncertainty. Trading signals are

clear in the middle of the chart, but as you get closer to the right edge,

you find yourself in what John Keegan, the great military historian,

called “the fog of war.” There is no certainty, only odds. Here you have

two goals—to make money and to learn. Win or lose, you have to gain

knowledge from a trade in order to be a better trader tomorrow. Scan

your fundamental information, read technical signals, implement your

rules of money management and risk control.

COURTESY:-come into my trading room