Hi friends,

Lets see how nifty has performed under different prime ministers of India.

The data is taken from PV NARSHIMHA RAO's tenure onwards.

I took data from PV NARSHIMHA RAO onwards as,He is often referred to as the "Father of Indian Economic Reforms". Future prime ministers Atal Bihari Vajpayee and Manmohan Singh continued the economic reform policies pioneered by Rao's government. He employed Dr. Manmohan Singh as his Finance Minister to embark on historic economic transition !!.

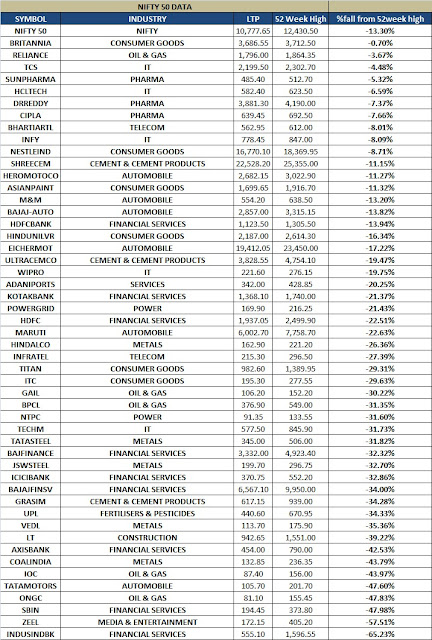

In the above table the data for narendra modi is taken till 14th oct ,His tenure is still not finished.

Lets see the nifty move in chart in different prime ministers tenure