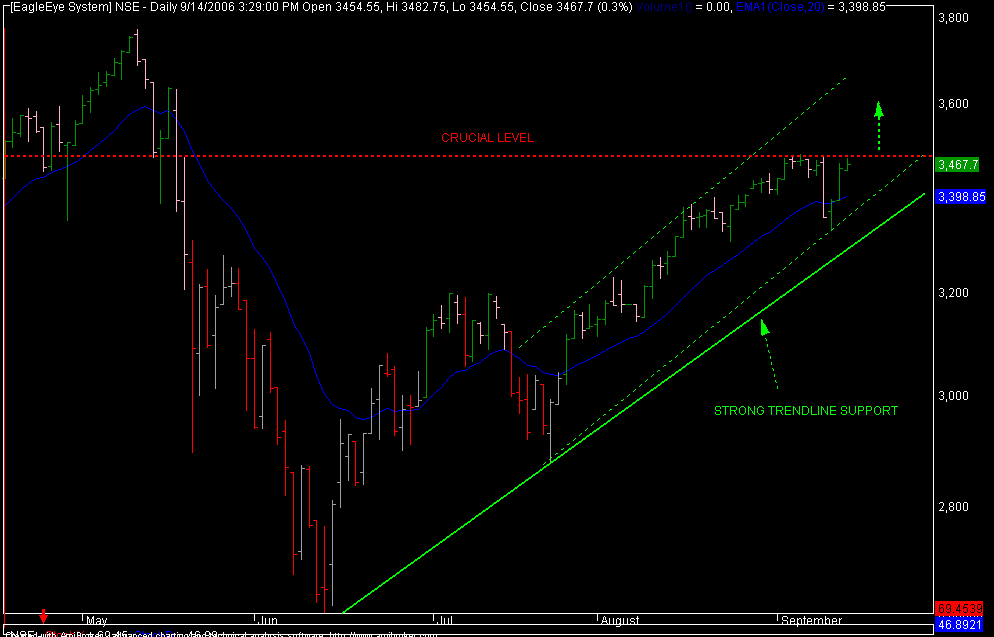

nifty resting on falling wedge resistive trendline if nifty holds it we can see a good upmove

cheers

rish

Even the best companies, industries, and sectors fall out of favor from time to time. A fully-informed investor, with a pocket full of cash and a firm understanding of the situation, can calmly stride into a turbulent market and buy up shares of these underdogs at a fraction of their intrinsic value. How do you know which companies are permanent losers and which are undervalued gems? Use these tests of quality to determine if you should invest your money or keep it stashed in cash.

Even the best companies, industries, and sectors fall out of favor from time to time. A fully-informed investor, with a pocket full of cash and a firm understanding of the situation, can calmly stride into a turbulent market and buy up shares of these underdogs at a fraction of their intrinsic value. How do you know which companies are permanent losers and which are undervalued gems? Use these tests of quality to determine if you should invest your money or keep it stashed in cash. y, if the recent advance tax payment figures of major Indian companies are any indication.

y, if the recent advance tax payment figures of major Indian companies are any indication. crore. Metal majors Tata Steel and Hindalco Industries have paid advance tax of Rs 450 crore (up 80%) and Rs 230 crore (up 70%), respectively, in September 2006. Other Sensex constituents, Grasim Industries, Bajaj Auto, L&T and Tata Motors, have also seen a rise in advance tax payment in a range of 14% to 94%.

crore. Metal majors Tata Steel and Hindalco Industries have paid advance tax of Rs 450 crore (up 80%) and Rs 230 crore (up 70%), respectively, in September 2006. Other Sensex constituents, Grasim Industries, Bajaj Auto, L&T and Tata Motors, have also seen a rise in advance tax payment in a range of 14% to 94%.

ons will negatively impact the US economy to a greater degree than any

ons will negatively impact the US economy to a greater degree than any s Curve, which runs from discovery through to depletion. In any given oil

s Curve, which runs from discovery through to depletion. In any given oil

Capitalize on the Most Explosive Markets of the 21st Century!

Capitalize on the Most Explosive Markets of the 21st Century! Consider India, China, Russia, Brazil and a host of other Asian, Latin American and Eastern European countries whose economies are developing at a frenetic pace. They are the next wave of growth markets. There's only one issue. Although in the long-run most of these markets will deliver capital gains dwarfing those of more developed economies (while also providing great dividends), in the short-term, many will be volatile. In order to profit,

Consider India, China, Russia, Brazil and a host of other Asian, Latin American and Eastern European countries whose economies are developing at a frenetic pace. They are the next wave of growth markets. There's only one issue. Although in the long-run most of these markets will deliver capital gains dwarfing those of more developed economies (while also providing great dividends), in the short-term, many will be volatile. In order to profit, emerging markets--information that will allow you to take advantage of the most lucrative long-term bull markets of the 21st century.

emerging markets--information that will allow you to take advantage of the most lucrative long-term bull markets of the 21st century. pany to 15.28 per cent.

pany to 15.28 per cent. tly, Tata Sons had increased its stake in Videsh Sanchar Nigam Ltd by 2 per cent to 7.64 per cent through open market purchases, thus taking the promoter group's consolidated equity stake in VSNL to about 49 per cent.

tly, Tata Sons had increased its stake in Videsh Sanchar Nigam Ltd by 2 per cent to 7.64 per cent through open market purchases, thus taking the promoter group's consolidated equity stake in VSNL to about 49 per cent. pment that had followed Tata Sons Chairman Mr Ratan Tata's address to shareholders at the AGM stating that the only safeguard against hostile takeovers was to increase the promoter's shareholding. - PTI

pment that had followed Tata Sons Chairman Mr Ratan Tata's address to shareholders at the AGM stating that the only safeguard against hostile takeovers was to increase the promoter's shareholding. - PTI